H&R Block Complaints Continued... (Page 2)

133+ reviews added so far. Upset? Call H&R Block corporate: 1-800-472-5625

I believe that H&R Block is unfair to retires. Tax preparation for a simple return that has W2 forms is $59.00. Tax preparation for a retiree, no matter how simple the return is, starts at $139. And then more fees are added if there is interest to report. I paid just a couple of dollars less for the reporting of my interest than I received in interest. And the interest reporting fee increases with each increase in interest. Also they charge $59 for the preparation of the State return even if there is no state taxable income. My tax return ended up costing me $209 even with a $25 coupon. I am accustomed to paying less for things as a retiree, not more. Retirees are a segment of our community who usually have less of an income than the taxpayers with W2 forms, and they should not have to pay more for tax preparation when the return is a simple one.

We are writing in regard to the H&R Block office at 248 Country Side Plaza, Mount Pleasant, PA 15666. We had an appointment for today, Feb 4, 2019 at 2:00 PM. When we got there the office was quite busy but we didn't worry because we had an appointment. Well after 30 minutes of waiting we were told that they were running behind which was fine but that we would have to wait longer because there was someone else that had walked in with no appointment before us and wanted to see the women we were scheduled with (Beverly Queer). Now we understand that she was behind but we had the appointment and to have to wait until someone who just walked in would go before us was not right. The receptionist was so unprofessional when we went up to cancel the appointment, all she could say when I said but we had an appointment was "I know, I know". So why make an appointment if they are not going to honor it. We will never go there or recommend them to anyone ever again. That appointment should have bumped the walk in person immediately and when Beverly was done with the client she was with we should have gone in and not wait for someone who was a walk in bump us down. We would not give this office a good review at all and if we could no stars at all. It was a terrible experience.

Timeline Tax Return Filing 1/20/2019

Date Action Taken

1/20/2019 Filed 2018 taxes with H&R Block

Located 16852 N Cave Creek Rd, Phoenix, AZ 85032

Doreen Ugalde is the Senior Tax Analyst. Also, I applied for the Refund Advance on that day.

1/23/2019 Doreen called from H&R Block office stating the Pin is wrong on the return. She also said the return was rejected by the IRS on 1/23/2019. She also stated that she will re-apply for the Refund Advance for me because my return was rejected by IRS on the 20th.

1/23/2019 My federal return was accepted by the IRS.

1/24/2019 State return was accepted by Arizona.

1/29/2019 Received Arizona refund on the Emerald card and H&R Block took their fee of $350.00 approx.

At the time of the filing of my 2018 taxes I applied for the Refund Advance loan and as of today I have not received any word from H&R Block about the status of the loan. Each time I have called either the local office or the customer service department I get the loan request is pending. It has been pending since 1/23/2019.

Each time I have called the local office or customer service they have blame each other for

the issue neither one has offered to help me resolve the issue. The only thing I have been told,

if I called the local office they tell me to call customer service. I called customer service and

they tell me to call the local office I did my taxes and to speak to Doreen Ugalde.

I just want the issue resolve and not get the runaround about my taxes. For the last ten years I have filed my taxes with H&R block and never encountered such chaos and confusion. This

year between the local offices and customer service in H&R Block no one seem to know what

is going on with taxes and how to resolve issues concerning taxes. I have been waiting over 5 days to get an answer about the loan status. For the confusion and chaos, I would like to be

reimbursed my filing fee of $350.00 and $3500.00 for the stress and anxiety of this. I am

thinking about leaving H&R Block for all the crap I had to put up with this year. And I will inform the BBB. Also I will inform my Friends and Family to leave H&R Block. I have called the local media TV stations and they want to do a story about H&R Block horrible tax experiences for 2019.

Sincerely,

Dawn Higgins

I even told the woman lisa uphsus in the batesville office that our vehicle reg were deductible an she said no it wasnt well i lost that deduction. She totally screwed us on our indiana state taxes.

THEY ARE A BUNCH OF LIARS AS I JUST SAW THE COMMERCIAL SEVERAL TIMES AND IT STATES YOU CAN GET UP TO $3,000 CASH ADVANCE WHEN YOU FILE IN PERSON OR ONLINE. I WAS TOLD YOU CAN ONLY DO IT IN PERSON BUT THE COMMERCIAL STATES OTHERWISE. I COULD HAVE HAD MONEY A FEW WEEKS AGO WHAT A JOKE.

Had an appointment for 6pm and the walk ins were taken before us after waiting an hour. So I'll take my business elsewhere. 2nd loop road Florence SC 29501

I have been a loyal client of H&R Block for 15+ years and the last 2 of 3 years have been the absolute worst I have ever experienced. Overcharged and poor service and attitude, period. Especially, Sandra at the office on Joy Road, in Canton, Michigan. "Yes, it's $198 to prepare your taxes, what do you expect???!!!" Not only can I prepare my own taxes for free online, but I am a United States Marine Veteran who has access to free tax preparation. I believe in supporting other's work and the local economy, however, next year forward, you will not have me as a client. I will strongly recommend to any and all that ask me, not to use H&R Block. If you had fewer stars to give, I would do so, but voting with my wallet and no longer using your services speaks volumes. Good luck. Regards, Keith Webb, Plymouth, Michigan

H&R block called me and schedule an appointment for me I went in 15 minutes early and then they told me all were sorry we don't have time to take you today

I rang H&R Block Lismore to get my last 2 years tax returns for the purpose of a home loan top up. I spoke to the receptionist Lyndall. She was rude from the word go. At the end of the conversation she hung up on me. I couldn't believe she did that. I've been going there for something like the last 10 to 15 years. Not going back there anymore. I do not need to be spoken rude to. I am a polite man and I don't need no young check girl being rude to me and hanging up in my ear!! I am an Employment Consultant at the moment and I will be sure to tell everybody of the rudeness of H&R Block.

I contacted the H&R Block office that prepared my return the last few years needing information from prior years return because this year I am doing my own. My best friend has prepared my taxes the last several years as her and her husband ran 4 offices in Sparta , Red Bud , Chester and Waterloo Illinois. Since last tax season they have divorced and earlier this year I needed info for my daughters fasfa and contacted my best friend to see if she knew how to get ahold of someone in the office and she sent her ex Husband Matt Eisenhauer and the office manager a message asking if they could please email me a copy of my 2017 return. They did not contact me nor email the info I was asking for. I just received a nasty email from Matt Eisenhauer trying to degrade my best friend. Nothing got taken care of then and I dropped it. Now I need the information for my own tax return and called the office and the woman named Donna who answered in the Sparta office was nice until I told her who I was and what I was needing. She even made a snide remark telling me good luck at getting ahold of matt myself. I then tried calling Matts personal phone and no answer and then sent him a text message and he again would not help me. Said he could not because of privacy. I understand that but I live 4-5 hours away and I've always conveyed my tax info thru email and approved everything in the past. I can verify who I am also. That being done I called the Bloomington office and they were amazing helped me right away with no hassle. Its sad that someones personal life can dictate how their clients are treated whether family, friends or neither. I should have been helped by someone and not had to go through the mess I did to get the information I was needing.

been going to HR BLOCK for 30 yrs file her tax and mine we just changed to Jackson hawet last 2 years there always high rates that's why I switched didn't want to we both file short forms takes 15 min to do. thank you

Vincent r liberato 9146088569

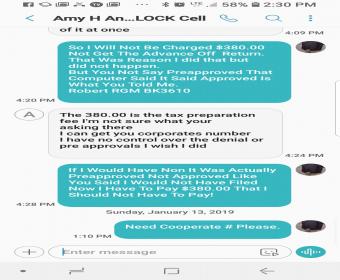

Yes my name is Robert Kiser I have always done business with H & R Block filing my Taxes every year!

Anyway I went a week before Christmas got $500.00 advance on the Emerald Card

Amy Elmore the Mgr took care of me and stated that I could come back on January 2, 2019 get $3000.00 advance on my tax refund that I was approved already and not have to file my taxes at that time.I went January 2nd the office stated they were not doing any refund advances due to government shut down.

I then found out that had changed so I went back January 10th 2019.

Amy Elmore started to do everything and said my money would be on my card probably the next day due to being after 5pm.

I then got a text a hour later stating I had been denied and would get a letting within 30 days in the mail.

This is my problem and H & R Block Officer Stated that I was approved and then hour later I get a text stating I was denied! This Is Totally Unprofessional.

I reached out to Amy Elmore sent her the message I received she said she would look at when she got back into the office she what she could do.

I Text her and she stated it was denied still .

Now this has cost me $389.00 tax preparation fee that I would have avoided if I would have known in this in the first place.

I ask for H & R Block Cooperate # she stated that her District Mgr said this was preapproval only!

Now And H & R Block Told Me That I Was Preapproved And Was Mislead!

This Is Not How You Do Business At All ! Now I'm In Financial Hardship Do To Being Misled By And H & R Block Officer And Mgr Of The Office!

I Did Not Want To File My Taxes At The Time And Was Told I Did Not Have To Get The Refund Anticipation Loan!Then In The Process She Stated That I Have To Get The Loan!

Also The Tax Credit I Think Was Wrong!

It Said I Was Only Getting $568.00 Per Child I Have 3 Dependents I Never Received That Low I Was Told That Had Increased To $2000.00 Per Child!

This Has Been Totaly Handled Incorrectly At Best!

Last I Dont Want My Full Refund In This Emerald Car I Wanted To Go In My Bank Account!

My Question Is Can This Be Reversed And Not Have To Pay All This Money Since I Was Mislead By And H & R Block Officer!

I Want This Addressed Immediately!

Office I went To Was

H & R Block

3500 Ross Clark Circle Ste 350

Dothan AL 36303

Amy Elmore Was The Office Mgr That Took Care And Completed Everything!

I Want A Resolution On This Immediately!

Robert Kiser

Rkiser74@gmail.com

334-797-0909

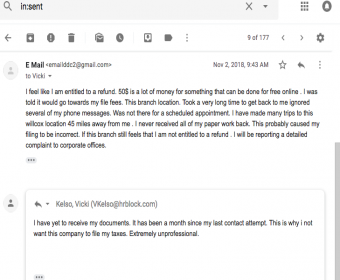

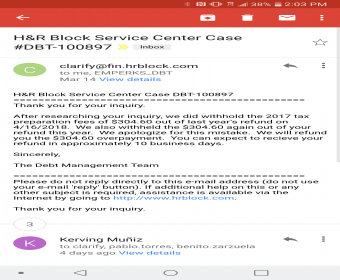

If i could rate lower than 1 star i would. Here is my experience . I have detailed emails . I went into H&R Block @ 676 N Bisbee Ave, Willcox, AZ 85643 to try to file my taxes . After i gave them all my documents and made an appointment .NO ONE returned my calls ever. I called several times to try to finish my tax return. After several attempts and many voice mail and email messages. NO ONE at this location answered my contact attempts. I had an appointment on july 4th . No one was at this location for my appointment. This location is not close to me and it is difficult to commute . I was told the fee they charged me would go towards my fee to file . I know how to do a FREE extension online. However i needed special help prep due to starting a new business. It was getting close to deadline so i attempted to once again go to this location. They had no information for me and had passed my "file" to another person. I then asked for my documents . After a very confessed receptionist scrambled to find my file. My documents were not all returned. I did not have all my records to file my return correctly. I politely asked for a refund and my documents to be returned . I still do not have the documents that I had left with that office. I am extremely dissatisfied with my experience. I am absolutely entitled to a refund and should be reimbursed in full.

Dominic Capanna

168. e papago

85606

emailddc2@gmail.com

520-833-0104

Me and my wife contacted H&R block in Oxnard California regarding current and past tax returns which needed to be completed

for our business due to Pay Pal doubling our revenues and making us have to go back three years and input all sales etc by hand

so when we took our returns to H&R Block in Oxnard Calif we spoke to a Sabrina Prendergast and explained our problem and that we needed to get this started ASAP due to letters from the IRS she said that she had never done business taxes but her associate would help her with them SHOULD HAVE WALKED OUT RIGHT THEN but due to our past tax preparation company costs are way more then we could afford we thought that since it was H&R Block whom was supposed to be a reputable company that they would be able to help us that was on Sept 20 2018 it is now December 9th 2018 and we have not heard a word from them we have tried contacting them with no luck now the IRS is sending letters stating the amounts owed and saying they are going to start garnishments how can we get help with this issue ? Please Help

Jeff & Traci Hicks 805-861-4448

Went out of state for work. Went to use emerald card wouldn't work it was locked. Called customer service to get straightened out. She told me everything was good to go. Went to use my card locked again. Called customer service again where this last tells me previous one deactivated my card and that I need to get a new one. Either wait 13 days for one or drive half hour to get one. Asked for number to file complaint...would not give me one. I asked multiple times. Worst customer service I ever experienced. I will say that after I get my money off my account I will never use one of those cards ever again.

I FILED MY TAXES FOR THE TAX YEARS 2015,2016,2017 back in July (23).I was waiting on word of any refund when I called them the middle of Sept.They instructed me that they were never received.I called H&R block and the lady checked.Apparently weekly I am not sure if my name came up on a list ,or she overlooked it .She is a very capable woman but if I had not spoken to an agent with CRA.I still would be waiting.I filed with efile .I did not pay the extra insurance you might say because she recommended I did not.I could have and probably will go elsewhere in the future.I paid 273.00 at the time.I really do not expect you to do anything.I have lost faith in the customer satisfaction guarantees you may make.If you wish to contact me please use email cathymcallister03@gmail.com

I just received a bill from the CA FTB saying I owe them $1931 dollars because my "qualifying" dependent really doesn't qualify, even though your software said she did. Turned 18 in Nov 2017, but a full time high school/college student. I pay all her expenses. Check, check, check, But she made more than $4050 dollars in income, which according to them disqualifies her. YOUR SOFTWARE NEVER ASKED THAT QUESTION or I would have changed my filing status from HOH to SINGLE. Now I have to pay them $1931. You product is crap. Was told Turbo Tax would have COMPARED all returns for a family to one another and pointed this out, Yours doesn't. I have been a faithful customer for many years, not any more.

I own a small business just starting out. They have had my information for months now and still nothing. They say they are senior tax people and have been doing this for years. The spanaway office is where my taxes were transferred to because the office on Mt. HWY lied said they could do it but then said they had no idea how too. It takes weeks for them to call me back then gives me the run around and the lady Ann Marie is always out of the office and blaming her coworker Courtney for it not getting done .I could go on and on but I would never ever refer anyone to go to H&R Block . I personally think they all should be fired.

your holding my refund check hostage since April 20 th, and refuse to send it to me

until your done making interest off of my money. and you could care less..Their isn't a single word in the

English language to describe how I feel about h&r block...I know your not going to respond to this

anymore than you return your phone calls.. your a mickey mouse poor excuse for a company..

how you continue to stay in business is one for Ripley's believe it or not. you belong behind bars.

your thieves..

After working with H&R Block for 10 years this will be my last year with them they did not file my correct taxes cost me an unnecessary fee and refuse to correct it

I filed my taxes in the East Haven, Ct office on January 17th. For the 2nd year in a row, they have messed up my state income tax, they can not tell me when my federal return was accepted and people are rude. I have asked 4 times for a manager to call me, and no one does. When I last spoke to the person who did my taxes earlier this week, she told me she gets paid to file and I will get my taxes eventually. She stated I should have gone elsewhere. I feel I shouldn't have to pay for the services I did not recieve.

We filed our taxes as we usually do with H&R Block in Sigourney Iowa. When all was said and done we were told we were getting a rtefund of $4000 + from the Federal govt. and $1200 + from our State, a little over $5200. We asked at least 3 different times if the lady doing the taxes was sure and she said yes. We bought the piece of mind just to be sure. We paid $294 dollars and left the office thinking our taxes had been e-filed and everything was fine. 36 hours later, (a day and a half) we received a phone call from our tax preparer. She said the computer had updated and we now owe $2820 dollars to the federal govt. and would only get $183 dollars back from the state. This is an $8000 dollar mistake. We have tried to resolve this and we keep getting the run around. Twice we have been told someone from the claims department would contact us, no call yet, it has been several weeks. Each time we try to meet with someone from the office something always comes up they always have an excuse. We would just like our money refunded, our taxes filed correctly so we can be done with this.This has been going on for several weeks now. We will never use H&R Block again unless this is resolved to our satisfaction.

Had an appointment at 4 and bc there was 5 minutes before our appointment the tax preparer (Jackie) for our appointment looked at me and said "it's not 4 yet" then proceeded to take a walk in while we had to wait past out appointment time instead of take us 5 mins early!! Very upset and aggravated, as we do not file for free, we do in fact file for hundreds of dollars fee. We came in to the Zephyrhills, Fl location at 7856 Gall Blvd.

I was scammed by customer service to pay 24.99 for some plus benifits after paying i looked up online and found i was getting nothing at all different then the free version offers. I phoned customer service and was told its only 24.99 why are you so upset. I explained the situation and was told nothing they can do. The operator refused to give her name or operator number then hung up. I work for the newspaper in pa and i am sure im going to get this scam of hr block out to the public before others throw away there money. I called turbotax to get there referral info to place in my report.

H&R Block prepared my taxes for 2018, everything was fine until I was asked if I had medical insurance. I said I had it til September of 2017, she asked why, I simply said because I'm looking for a job. Then she proceeds to tell me that she is going to be the one to tell me that i need medical insurance. Frankly, its none of her business as to why i dont have it. I told her to stop talking about it and she continued to lecture me. Im an adult and im aware of what i need. I don't need to be treated as if i were a child. Her name is Patty costanza, n main location in rockford il

I went to h and r block to file my tax return and I was under the impression that I would receive funds that same day. I even asked the "tax professional" when the funds would be available on this card she gave me(The Emerald Card) and she told me within 24 hours. I was not happy that they charged me a total of $281.00 on a return of only $1,212.00 but took into consideration that this is the price I pay for a quick return. I even said so to the"tax professional" and she agreed. Turns out she was wrong. The correct answer would have been 21 days. If I had known this I would have done my taxes myself like I usually do and saved almost $300.

Hey H and r block.....tax season is not an ideal time to train.......the other "tax professional" that was doing the training was back and forth between her(the trainee) and other customers during my appointment. The last time I spoke with the tax professional that was doing the training was 3:00, she said she was going to call the higher ups and see what could be done. Thats what I get for counting on h and r block,> my husband is in the hospital and not doing well and I have 10 days to move due to the property being sold where we reside. I scheduled time off with my work so I could find a new home in time for when my husband is released from the hospital. I never should have put so much faith into h and r block....Now Im screwed. I may be stuck here, get evicted, and then how am I supposed to find someone that will rent to me? And the woman who was being trained.....dont blame her, she was not being properly trained, obviously. Thanks for taking advantage of me h and r block...NEVER AGAIN.

I've contact hr block 33 times yes 33. They said they did a investagation on my fraud statement. N they closed it. So I called again to ask them how they did this bc there were transactions being made at the same time 50miles apart. So then they assigned me Natale n she doesn't return calls. N when she does she try's blaming you. When I'm disable can't speak well n around on me. I explained I only have one card n she kept asking me if I gave it lost it etc.. n the transactions are being made at the same time in different areas n this has been going on since July n this is now October?? Hr block investagation was a bunch of crap... and since they sat on their thumbs all video evidence is gone. So yes I believe I have a right to be upset. N I want my money back

This is a note I had to sent to the recruiter for you classes in Orlando. I feel, in my worse day at work, I could do better at informing potential clients of class cancellations or changes. If this is the caliber of individual you have working, it is disappointing. I am positive I could do better.

Quezada, Marielle Michelle (marielle.quezada@tax.hrblock.com)

Good Morning

At the moment I am highly disappointed in H&R Block.

1. I never received the code you stated I needed to enroll in the course which started today, so

2. I went to the address where the course was to be held and waited until after 10 AM, the start time, and no one showed.

Is the evening class from 6:30 to 9:30 still going to be held.

Thank You

Not sure I will go with H&R Block anymore for my taxes. In the end they are starting to charge way more with the launch of "Block Advisors". It just does not make sense when Tax Act and others are charging $29 still and H&R is not getting with the times.

Please, do NOT hire H&R Block for financial services. They do document and rip off peoples personal and business information.

There was a charge put on my H&R Block account that I did not authorize and I've called over and over to talk to someone about this but I'm just getting the run around. I also wanted to stop the same company from being able to get more money over and over again. Will not be recommending this service after they ignored my phone calls to their customer complaint hotline.

Went to H&R Block to get my taxes filed the last three years. Each year the service seems to get a little worse, but the price stays the same. This past year they barely took 30 minutes with me and seemed very rushed. I hope they slow way down and get back to focusing on positive customer service experiences. That is my only complaint, and the change would need to come from the H&R Block corporate office.

No compaints here about the company. H&R Block helped me in filing my IT - returns for this financial year and it's a great relief. It is a full-service tax consultancy firm with qualified CAs, CPAs and other experienced Tax Experts for individual and Corporate accounts.

Well it is pretty necessary that we maintain and manage our financial transactions regular and H&R Block is the best place as it has 365 days frequency, error free and our documents are 100% secured. It not only helps in IT filing, but also in IT calculation, Tax scrutiny assistance, registration and advance tax quarterly services too. I suggest to ring up or text in H&R Block for the above services to get the best work done for you. I have done my taxes several years in a row and from the corporate office on down everyone in this organization seems to be world-class.

I did a drop-off tax return. When it was completed I got a call from the receptionist saying my return was done and we set up a time to come in at 6pm and sign the paperwork. When I arrived the paperwork wasn't ready and I was told to come back the next morning because the tax preparer was too busy with another client he had already. I left the office while my husband stayed to talk and figure out what was going on. So the tax preparer comes out of his receptacle and shows my husband a list of items that we are missing for our return. We had some of those items last year but not this year which I explained to the receptionist. There were things on the list that never even applied to us that could've transferred from last year's tax return. For instance, one thing he said we were missing was my income. I haven't worked since 2016. I have no income. Only my husband works and we turned the w-2 in. That couldn't have been on last year's return. Point is, I am not happy with the way things were handled when I showed up expecting to complete my return. I no longer live in that area but I still went to that one in particular because of the exceptional service the previous year. My tax preparer is Timmy Ogunsemi located at the H&R Block at 202 Hwy 54 Unit 405 Durham, NC 27713.

I just retired and moved in with my elderly mother. She mentioned that HR&BLOCK

did her taxes. Its just around the corner so I went there to have taxes done.I know taxes are pretty inexpensive these days. Long story short I was SHOCKED when she charged over $250 to have my taxes done. I was NEVER told until we were TOTALLY finished how much it would cost .IT WAS NEVER DISCUSSED. I could have taken them to a library or senior center and had them done for almost nothing. I am just sick about this especially when I read that pricing was suppose to be discussed AHEAD of time. I think I should get my money back. Rita Moon

My daughter normally does my taxes online but I have since moved to Michigan. My mother suggested I go to H&R Block because you did a good job and it was inexpensive. I probably could have gone to a library or to a senior center to have my taxes done for free or close but you are right around the corner from where I live so I thought I don't mind paying a little bit to have my taxes done. I was not at any time shown what this was going to cost me. Until she totally finished and told me it was over $250! And from what I understand what I read I'm supposed to be given an estimate before we even start. I was not given that! I would like my money back! She never verbally or physically told me what this would cost until we were TOTALLY finished.

H&R Block over charged services and I bring evidence that the charge has been paid and they send me a case number and an email apologize and clarify and that in 10 days I will receive the refund of the over charge and it has been a month and I didnt received anything. I call to the client service and nobody can help because they dont know anything and same in the office.

Made a payment arrangement for money owed to h& r block .which is just like a contract but instead of honoring this h&r block stole the money from my tax return .What kind of sneaky business is that.15 year customer us going to leave.

I have decided to use H & R Block to do my 2018 income taxes. I was not satisfied with their services at all. I'm very upset.

First of all, the person who had done my taxes was not professional. I had to help her with some printing issues she had on her computer. I was told to come back another time until the computer was fixed. In the meantime, the employee of H & R Block tried to reach out for help from her IT department without success. As I had to return a second time later that day, the printer was working. Since I was getting a refund from the Federal Government of Canada, I was not given a choice on how to receive my refund. A H & R Block Visa credit card was the only option I had to take in order to receive my refund. H & R Block didn't know how to submit my refund on this Visa credit card as I began to worry. I had to wait 3 weeks in order to use this H & R Block visa credit card ! I was charged $ 150.00 CAD + $ 19.95 CAD extra for this service including deposit and handling charges that they didn't accounted for !! I called head office 3 times and file a complaint. Since then, I"m still charge with these extra charges that was not aware of. I"m no longer going to file my taxes with them.

It was bad enough Lee Noel,at the H&R Block located at 13909 Nacogdoches Rd San Antonio, Texas was offensive during our tax preparation,she again displayed poor customer service when I called today to inquire about a problem. During the preparation,made a snide comment about being "just a housewife",and a condescending tone to her voice when making a comment about my former employment,a company I had worked for since 1998. Her nasty tone did not entice me to disclose any personal reasons,which were none of her business. Today, I called, because our check was $278.95 less than what she said it would be. After politely describing our check was less than it was supposed to be,she snidely asked,"annnd?"

The help she was willing to give was tell me,"the IRS accepted your return. If you have any outstanding debts,school loans,back IRS fines,they'd take it out. Call them,they accepted it." We have neither.

Over 20 years,I've used this company. After the preparation, was planning on using anyone but her in the future. Today I'm questioning whether or not I'll be using another company altogether. My work history is in customer service, hers requires intervention for customer satisfaction, and company income stability. It should not matter what kind of income a customer has to be treated with decency.

The Upfront pricing is Bullshit!!!!! They had the prices posted, but hald I known it would cost 450.00 to file my taxed I wouldn't have filed with H&R Block on Shelby Street in Indianapolis, Indiana.

I am trying to get an issue resolved regarding my income tax return. Our income taxes were filed online at H&R Block.com. in the process H&R Block offered a $100 bonus. the option we chose was the gift card from Amazon. On March 13th, $4.00 was deposited to our checking account, the other $2000.00 was wrongfully sent to Amazon. I have spoken with both H&R Block and Amazon multiple times to no avail. the following is a detailed statement of the process i have been through to attempt to resolve this matter.

To whom this matter concerns:

The following information is to the best of my knowledge.

My wife filed our income taxes(as she does every year) with H & R Block on February 6th, 2019. While preparing the taxes, it was offered to us that we would receive a $100

bonus as a first time filing customer. One of the choices was for us to receive a gift card from Amazon, this is what my wife chose. On March 14th, we received to e-mails from

Amazon, one for the $100 and the other $2000. At first we didnt do anything and waited for our refund to be deposited into our checking account. After about a week, we decided we should look into this matter and get some answers. I made a call to H&R Block, I got the run around and I was told it was in the hands of Amazon. So I called Amazon and on the first call I was told that H&R Block would have to cancel the transaction so that the $2000 could be sent back to H&R Block. In the next few days, making phone calls, we discovered that on 3/13/2019, $4.00 was deposited into our checking account. I called my bank to look for any information as to where the $2000 of income tax money went to. So making more phone calls to H&R Block, we finally find out that on 3/13/2019 H&R Block send the $2000 to (you) Amazon. On Wednesday 3/20/2019 I make a call to Amazon to get some answers, I connected with Miguel, explained the situation to him, he stated that would call H&R Block and have us on a 3way call, to explain that all H&R Block has to do is cancel the transaction. In the next 2 hours(plus), Miguel and I were bounced from department to department with each one stating that they could not do anymore and the next department would take care of us. Miguel finally became frustrated as well as I did with this, and hung up on H&R Block, and stated to me that he had an Idea to resolve this matter. Miguel said that we would have to go to the e-mail that we received and claim the $2000 on gift cards, this was by far what we wanted to do, but at this point felt it was the only option to retrieve our income tax money. So we started the process of buying $200 gift cards, 3 of them on 3/20/2019, 3 more on 3/22/2019, and then 3 more on 3/24/2019. On 3/24/2019 we received an e-mail that stated the payment was declined. This was confusing to us so I made another call to Amazon that night. the gentlemen we talked to figured out that our attempts to purchase the gift cards was done incorrectly and that none of the transaction were processed, and that our $2000 was still in that hands of Amazon. I made another call to Amazon on Monday 3/25/2019 and after talking to two agents I was transferred to Emily. Emily took a statement from me and said that she was sending this information to the card services department, that they were better equipped to handle this matter and that she would get an answer from that card services department and return a call to me. I never got that call and then made another call to Amazon on 4/1/2019, explained the situation to this female person(no name), she put me on hold, investigated, came back and said that a case file was generated. On 3/30/2019 we received an e-mail from Amazon stating that even though there is alot of this same information that it is requested of us to send an e-mail in explaining in as much detail as we could.

In closing, we have done our best to give you complete and accurate information to get a resolution. Thank you for taking the time to review this information.

According to Erica Royse (amazon), H&R Block just needs to contact the Amazon Corporate Gift Card services department, cancel the gift card transaction so I may receive my income tax return.

Sincerely, Joseph & Diane DesLauriers

I made an appointment with the H&R Block in Mainz Germany. I spent 20 min with them and took their advice on filing. They were “so busy” that they sent me away to work on my taxes. This consisted on filing a 1040X and then completing the paperwork. Three days later I received a bill for $354.00. When I went in to finalize my filing they did not even have the courtesy to help me electronically file or even show me what exactly they did. $354.00 for what? I would like to here back from management. This is unacceptable.

Your company pulled my SSN from the cloud or somewhere & put it on my son's taxes at your office branch. I used the new snap shot of your w-2, but did not file. Only checking to see what I would get. Not realizing this I filed electronically thru turbo tax and got denied because someone else used my SSN. This started a huge mix up and took several days too figure out. Your branch office helped us, but I had to file by mail and have at least another 12 weeks to wait on my return. I am in desperate need of my return and usually have it before the 2nd week of February! I am getting more agitated every day I think about it. Called the IRS and it took them an hour to find my papers or it would have been longer!! Your company needs too look into how this could have possibly happened and fix it. I am thinking of talking to my lawyer because there is something shady and would like to have my money and have you wait. How many times have my SSN been used since then. Please make sure this doesn't happen!

Regards

HELEN QUINTA SCHENCK

qschenck@comcast.net

7307 WESTMINSTER COURT

UNIVERSITY PARK, FL 34201

April 2, 2019

To: H & R Block Complaint Dept.

Subject: H & R Block Complaint

Gentlemen:

I have been an H&R Block customer for over 10 years and have never experienced a major problem until now. I use a desk top computer, Microsoft, Windows 10.

April 2, 2019 8:30 am I completed H & R Block 2018 FULL VERSION TAX SOFTWARE DELUXE FEDERAL AND STATE. The finished report was ready to print……..it did not print for mailing, This is what was printed on top of my printed tax forms

“DRAFT FORM - DO NOT FILE. Final form will be available through a program update.”

Following the directions on the screen I hit the update button over and over again…to no avail. I called the 1-800-HRBLOCK (800-472-5625), reached a lady agent. I answered her questions and she proceeded to direct me to hit keys for over an hour until she finally

said “she was transferring me to someone else who could help me. The diskette was faulty and H & R Block has problems with this program and I could not make updates on my computer because it has an outdated Federal Verification #3901 and THE CORRECT CURRENT ONE IS #8301.”

The agent continued hitting keys into her computer and requesting me to do the same to update the software. Her actions took up a lot of time to try the things an agent does, only to end up with me not having access to the internet. At this point her directions left me with a totally unfamiliar screen and no internet connection. I could not open anything. In the lower right hand corner of my screen was a picture of an airplane, I was in airplane mode. I had been deleted from the internet. She said “she was transferring me to someone else. She did not give me her name. It was now 11:00 am. I started working with her at 8:30 am.”

At 11:05 am the new agent was a gentleman who struggled to unravel this computer software and hard drive problem. Nothing worked…was with him over an hour He could not fix the problems and hung up after 12 noon, leaving me hanging with no internet connection. He did not give me his name.

12:30 pm I called Computer Doctors my technical assistants and explained I was in airplane mode, with no internet connection because H & R Block agents attempts to fix a software problem. They told me a technician would be at my home by 3:00 pm.

12:45 pm I tried once again to see if H&R Block could solve these problems. I called 1-800-HRBLOCK (800-472-5625) explained about the faulty 2018 tax software. When I reached the next agent she applied a case #1596363 only for her to say “I was in the wrong department” and transferred my call to someone else. I held on for twenty minutes, no one answered. I hung up and waited for Computer Doctors. This was an exhausting day.

3:05 pm Computer Doctors arrived. Technician: Brad Here is his diagnosis & Solution.

“Problem: Couldn’t print using H&R Block software…called for support, they (H&R Block) remotely connected and somehow after the network connection was lost and in permanent airplane login credentials to the pc were changed as well. PIN was removed and password changed …was able to rollback computer to previous day undoing changes made. “

“Solution: Was able to update feature. Had to change the screen resolution to allow the print button to be seen. Software does not scale to the screen resolution. Left computer as max resolution. Updated the Microsoft account password. “

He was here 1 hour and fifteen minutes cost rate $99.00 per hour. He put me back on the internet.

I am requesting reimbursement for the defective diskette and the cost for Computer Doctors house call. I am not responsible for the cost of 2018 tax software which is defective or the technical assistance required to clean up the technical problems created by H & R Block’s agents.

Attached are copies of the invoices

2018 Tax Software, Deluxe + State $48.10

Computer Doctors technical assistance house call $123.75

H&R Block

H. Quinta Schenck,

Thanks for purchasing H&R Block 2018 Deluxe Federal + State. You’re on your way to getting your maximum refund -- guaranteed.

Name: H. Quinta Schenck

Address: 7307 Westminster Court

University Park, FL 34201

Product: H&R Block 2018 Deluxe Federal + State

Product: H&R Block Tax Identity Care: No

Credit card: xxxxxxxxxxxx4021

Price: $44.95

Sales tax: $3.15

Total: $48.10

COMPUTER DOCTORS

1 / 1

Invoice No: 2127

Date: 04/02/2019

Bill To: Helen Schenck

qschenck@comcast.net

7307 Westminster Ct

Bradenton, FL 34201

Invoice

PO Box 1667

Palmetto, FL 34220

(941) 739-3600

Problem: Couldn’t print using. H&R Block software - called for support, they remotely connected and somehow after that network connection

was lost and in permanent airplane Login credentials to the pc were changed as well. PIN was removed and password changed

Solution: Was able to rollback computer to previous day undoing changes made. Was able to update software using the auto update feature.

Had to change the screen resolution to allow the print button to be seen. Software doesn’t scale to the screens resolution. Left

computer as max resolution. Updated the Microsoft account password

Description Quantity Rate Amount

Hourly Rate 1.25 $99.00 $123.75

Payment Details

Credit Card

Subtotal $123.75

Total $123.75

PAID $123.75

Balance Due $0.00

Your company pulled my SSN from the cloud or somewhere & put it on my son's taxes at your office branch. I used the new snap shot of your w-2, but did not file. Only checking to see what I would get. Not realizing this I filed electronically thru turbo tax and got denied because someone else used my SSN. This started a huge mix up and took several days too figure out. Your branch office helped us, but I had to file by mail and have at least another 12 weeks to wait on my return. I am in desperate need of my return and usually have it before the 2nd week of February! I am getting more agitated every day I think about it. Called the IRS and it took them an hour to find my papers or it would have been longer!! Your company needs too look into how this could have possibly happened and fix it. I am thinking of talking to my lawyer because there is something shady and would like to have my money and have you wait. How many times have my SSN been used since then. Please make sure this doesn't happen!

Regards

HELEN QUINTA SCHENCK

qschenck@comcast.net

7307 WESTMINSTER COURT

UNIVERSITY PARK, FL 34201

April 2, 2019

To: H & R Block Complaint Dept.

Subject: H & R Block Complaint

Gentlemen:

I have been an H&R Block customer for over 10 years and have never experienced a major problem until now. I use a desk top computer, Microsoft, Windows 10.

April 2, 2019 8:30 am I completed H & R Block 2018 FULL VERSION TAX SOFTWARE DELUXE FEDERAL AND STATE. The finished report was ready to print……..it did not print for mailing, This is what was printed on top of my printed tax forms

“DRAFT FORM - DO NOT FILE. Final form will be available through a program update.”

Following the directions on the screen I hit the update button over and over again…to no avail. I called the 1-800-HRBLOCK (800-472-5625), reached a lady agent. I answered her questions and she proceeded to direct me to hit keys for over an hour until she finally

said “she was transferring me to someone else who could help me. The diskette was faulty and H & R Block has problems with this program and I could not make updates on my computer because it has an outdated Federal Verification #3901 and THE CORRECT CURRENT ONE IS #8301.”

The agent continued hitting keys into her computer and requesting me to do the same to update the software. Her actions took up a lot of time to try the things an agent does, only to end up with me not having access to the internet. At this point her directions left me with a totally unfamiliar screen and no internet connection. I could not open anything. In the lower right hand corner of my screen was a picture of an airplane, I was in airplane mode. I had been deleted from the internet. She said “she was transferring me to someone else. She did not give me her name. It was now 11:00 am. I started working with her at 8:30 am.”

At 11:05 am the new agent was a gentleman who struggled to unravel this computer software and hard drive problem. Nothing worked…was with him over an hour He could not fix the problems and hung up after 12 noon, leaving me hanging with no internet connection. He did not give me his name.

12:30 pm I called Computer Doctors my technical assistants and explained I was in airplane mode, with no internet connection because H & R Block agents attempts to fix a software problem. They told me a technician would be at my home by 3:00 pm.

12:45 pm I tried once again to see if H&R Block could solve these problems. I called 1-800-HRBLOCK (800-472-5625) explained about the faulty 2018 tax software. When I reached the next agent she applied a case #1596363 only for her to say “I was in the wrong department” and transferred my call to someone else. I held on for twenty minutes, no one answered. I hung up and waited for Computer Doctors. This was an exhausting day.

3:05 pm Computer Doctors arrived. Technician: Brad Here is his diagnosis & Solution.

“Problem: Couldn’t print using H&R Block software…called for support, they (H&R Block) remotely connected and somehow after the network connection was lost and in permanent airplane login credentials to the pc were changed as well. PIN was removed and password changed …was able to rollback computer to previous day undoing changes made. “

“Solution: Was able to update feature. Had to change the screen resolution to allow the print button to be seen. Software does not scale to the screen resolution. Left computer as max resolution. Updated the Microsoft account password. “

He was here 1 hour and fifteen minutes cost rate $99.00 per hour. He put me back on the internet.

I am requesting reimbursement for the defective diskette and the cost for Computer Doctors house call. I am not responsible for the cost of 2018 tax software which is defective or the technical assistance required to clean up the technical problems created by H & R Block’s agents.

Attached are copies of the invoices

2018 Tax Software, Deluxe + State $48.10

Computer Doctors technical assistance house call $123.75

H&R Block

H. Quinta Schenck,

Thanks for purchasing H&R Block 2018 Deluxe Federal + State. You’re on your way to getting your maximum refund -- guaranteed.

Name: H. Quinta Schenck

Address: 7307 Westminster Court

University Park, FL 34201

Product: H&R Block 2018 Deluxe Federal + State

Product: H&R Block Tax Identity Care: No

Credit card: xxxxxxxxxxxx4021

Price: $44.95

Sales tax: $3.15

Total: $48.10

COMPUTER DOCTORS

1 / 1

Invoice No: 2127

Date: 04/02/2019

Bill To: Helen Schenck

qschenck@comcast.net

7307 Westminster Ct

Bradenton, FL 34201

Invoice

PO Box 1667

Palmetto, FL 34220

(941) 739-3600

Problem: Couldn’t print using. H&R Block software - called for support, they remotely connected and somehow after that network connection

was lost and in permanent airplane Login credentials to the pc were changed as well. PIN was removed and password changed

Solution: Was able to rollback computer to previous day undoing changes made. Was able to update software using the auto update feature.

Had to change the screen resolution to allow the print button to be seen. Software doesn’t scale to the screens resolution. Left

computer as max resolution. Updated the Microsoft account password

Description Quantity Rate Amount

Hourly Rate 1.25 $99.00 $123.75

Payment Details

Credit Card

Subtotal $123.75

Total $123.75

PAID $123.75

Balance Due $0.00

One of the most horrible customer service experiences I've ever had the I areas had told me that they had deposited my IRS tax federal refund in to the bank account on the Emerald card and it was on the April 2nd on April 4th 1 I called customer service Emerald card they told me I had to wait until the 16th and that they Would not verify any banking are card information with me they just told me there was nothing they could do. I will never ever ever use H &R block tax processing system again what

Tax preparers Sherri Wells AFSP ay H and R block totally screwed up my taxes. I specifically ask that the onjured spouse form was completed before sending off my federal . Come back to pick up paperwork she did not even complete it. Second after paying and sending my efile i look through my paperwork and she Gave all the credits to the non injured spouse. I called to the H and R block and filed a complaint with her manager

I have filed a complaint and have not had a response. Actually tried several times and can’t get a response. How can I get a response. Please

The representative that I tried to work with had limited facility in English but I wanted to give her another opportunity after the terrible service for tax year 2017. No improvement, actually worse because she again could not find " date of birth" on my military identification card. Still had issues reading typed letters from charitable organizations. Adequate data entry. This year, 2019, H&R Block has new forms that require both filers' signatures but this was not mentioned until the tax forms were completed. When I returned the next day with my spouse's signature on their form the representative was unavailable and no one would sign in her stead. Ultra inconvenient, so I sent a copy of all the H&R Block forms to the local office with cc to corporate headquarters via registered mail. Time to find another tax preparer.

On or around January 29, 2019 I had my taxes prepared by H & R Block in Ladysmith, WI and within two weeks I had received my State of Wisconsin refund. On February 19, 2019 I received a State of Wisconsin, "NOTICE OF AMOUNT DUE - Individual Income Tax", Amount Due $1.151.00. The H & R Block Protection was purchased and I am covered. (PROBLEM) Employees Chris or Patti (715-532-6982) kept my Return for their follow up and told me to check back in a week...they were very busy. I waited the week and called...Was told they had not gotten to it. *Chris or Patti or whoever answered the phone sounded perturbed. Told me not to call them as they would contact me. Received an e-mail the the amount due was re-figured at around $350.00 and the State of Wisconsin would send me an update. Today, March 30th and I haven't received anything and don't know what to do next. I inquired again by e-mail. I was told to call the State to find out. I e-mailed back...I need a phone number or file number as I wasn't sure what to do. **I thought the 'Protection Plan took care of these high anxiety details. My filing was husband/wife with Social Security and my State Retirement benefit. *Should have been easy ($59.00) range but I was charge $200.00 with the Protection Plan included. Two weeks to go and I have no idea what to do next and the Ladysmith, H & R Block doesn't seem willing to pursue customer satisfaction. All I want is to know how much I need to RETURN to the State of Wisconsin so I can conclude this years filing. I hope someone can help me, only TWO WEEKS to go. Ladysmith has been sitting on 'their' 'ERROR' for SIX WEEKS and I am in a state of high anxiety waiting for ANY answer or direction...including phone numbers. Wasn't my protection aimed at solving these potential problems? SO far, something may have been done but NOTHING accomplished. Ladysmith Office has my Returns. I don't know what to do next...PLEASE HELP

We have been coming to the same place for a few years and the same lady at the front desk makes us feel terrible with the way she speaks to us. Not only are we the only ones not addresses with customer service, when asked for our personal information does not explain why she needs it. It makes me feel very uncomfortable with this place having my information. I booked the appointment online After the initial sign in she complained that I was with my partner but as the information shows I am common law and was making the initial appointment but clearly stated my significant other would be with me. As soon as we sat down, an email was sent to me cancelling the appointment. So, already upset with this lady I asked why I just received an email...her supervisor was there and both instead of apologizing gave me unprofessional looks along with saying they are not responsible for online bookings and it’s not their problem but the appointment is still booked and I should call the number online. At this point I walked away as non of what they were saying made sense. As others came in the door thought they were picking up the customer service so at least others were not treated as we were.

I've been a client 30 yrs. or more. 2017 changed filing office due to move. All went well. Returned for 2018 filing appointment. Block associate searches my name. Long story short. Voice in adjacent cubicle holds negative conversation as my info is read aloud. Turns out faceless employee did my taxes previous year. As I make appointment she comments "dont give her to me. I'm busy enough". Sadly, she had clients at the time. A disservice to them as well as myself. Unprofessional to say the least. You still have my business but never again at that location. Harbor Shops Havre de Grace Md.

We were told we would receive a refund of $5,278.00 and paid $328.00 for a service fee. Left office, got home later and was told there was a "glitch" in the H&R Block calculation software. Since taxes already filed, we had to write a check to the IRS for $1374.00. Home office sent us a refund of $130.00, insulting!!! Went to office and agent had manager sit in, when I asked for a refund of the $328.00 minus the $130.00, we were told they didn't charge us the $100.00 amendment fee. This was not our fault! Never. Ever. Again.

Do not use H&R Block, 2625 Lawndale Dr, Greensboro, NC 27408. And the agent was Jeannie B Fisher.

Sent a email

Zero stars

I filed my taxes with h&r block I paid for a representative lawyer to represent me if the irs start harassing me about anything. It is the tax preparer that approved an advance for me and lied to me how much money I would be getting back on my tax return then said I was approved for the advance. I receive the advance and in a week or two later I came back to file my taxes it was a scam. I never was getting that money I was approved by the loan for because I did the advance before and by my pay stub I show them I get approved. How did I get approved in the first place, the representative lawyer I paid you for against the irs I need them to represent me on this scam saying I have to over pay my refund.

Had taxes done on 3/11/2019 at H&R block in potosi mo. Was never told cost of tax prep til I got home and was looking at papers and saw I was charged $340 for standard deduction head of household with 1 dependent, no itemizing at all. $416 dollars total with other fees. I called into office and he said he would give me back $90. I use to always have my taxes itemized in the past at another tax place and it was never over $200. I feel I was overcharged at least $200. What is the price for a standard deduction married filing separate, no itemization? Won’t ever use H&R block again.

Linda Mang took over a year ( 15 weeks prox.) to cancel my corporation at the Liberty Plaza, Erie,Pa. site. She asked me if I cared how long it took and I did not care. However I didn't realize it was going to cost me another $500.00 to complete the cancellation in 2019 after the 2018 cancellation.

One of your tax preparers did my return wrong for the year 2017

I now owe the IRS $10,000.00 due to my return being wrong.

I am 93 years old and have no way to come up with $10,000.00 dollars.

Sincerely,

Maurice Smith

432-935-2650

I purchased H & R Block software, completed it, then had the local H & R Block office review it. I needed to review an additional tax form before filing. I was directed to H & R Block web site and somehow ended up online for online tax return preparation, even though I already did it with the software. I was unable to reach a representative to cancel that online tax return and could not cancel it. I do not want to pay for it. Please delete the early start of that online tax return. Thank You

It's extremely difficult to reach an representative to remedy this problem.

I was told from sbtpg 877.908.7726H&R block bank is still holding on my refund since 2/27/19 I need to know when are they going to release this to my acct? my acct m&t bank routing 054000030 my acct 5502819262 as of 2/27/19 its in the acct of avista bank routing#044111191 acct# i9810178577192436 h&r bank need to know when are they gonna release my refund in amount $1,026. been over 3 weeks tax 2018

Hello, I spoke to your corporate office some time ago because my 2016 taxes was done incorrectly by my local HR block and they would not take responsibility. I only assume you spoke to them and then I received a call from the person who runs that office Melisa Radeke and she stated that her office would file the amendment and that they would pay any late and or penalty fees. I had been waiting and waiting and waiting on the answer from the IRS office about my amendment and checked with Priscilla Harris as to why I hadn't received any notification yet. Priscilla apparently contacted the IRS and they stated I would receive something in 2 weeks. A few months went by and nothing but I did receive a letter stating that HR Block would not be taking any responsibility nor pay any penalty or late fees. I thought this was a mistake since Melisa had already stated the would so I ignored the letter thinking that maybe it had been sent out in error. So since I hadn't not heard back from Priscilla or the IRS I email Priscilla again only to receive an email back stating that if I had any questions going forward to contact Melisa. She has not or will not call me back!!

Can someone PLEASE explain to me WHY I am being treated this way? I have NEVER not paid my taxes nor EVER not filed nor been in trouble with the IRS! The ONE and ONLY time I went to company to have my taxes done they not only do them WRONG but because of their mistake I end up owing more then I should and on top of that end up with late or penalty fees and be given the biggest run around and lied to!

Please contact me and explain to me how the corporate office would want or continue to employee someone who would do this to a customer!

Thank You

Cindy Lapine

628 Sugar Brook Dr

Temple, Tx 76502

512-797-7902

Someone got a hold of my emerald card and took all the money off my card I don't know how they found out my pin to my card what can I do? I never recieved text on my phone saying money was being taken out

Droped off my tax documents at one of the offices that had prepared my taxes previously and was notified that the preparer could not do it and it was transfered to another office. Was assigned another preparer and months went by without any progress. After 6 monthes of emails and office visits the agent was incapable of doing the return!!!!!!!

As a reuslt I was sent over $5,000.00 worth of penalties and fines from the IRS.

Filing a complaint and hoping they Fire the Preparer and paying the fines!!!!!!

My mother and I, Yvonne Howard, are regulars at H&R Block. We have been getting our taxes done, with no complaints, at the same location for several years in Clinton Township, Michigan on Garfield Road. We have also been getting them done by the same tax specialist, Sotira Rrumbullaku, for a few years. This year we scheduled nothing different to have them done by Mrs. Rrumbullaku on March 2nd, 2019 at 2:15pm. We arrived at 2:15pm on the nose and was addressed by the office manager, Cynthia Zalewski, who simply told us that we'd be with her and to follow her. We paused and asked where was Sotira, whom we scheduled with. She told us that she had a family emergency and would be out of the office for a few weeks. We hesitantly agreed and followed her to her cubicle, where she began handling both of paperwork and organizing them into folders. My mother asked Ms. Zalewski if she wanted her to move some things out of the way, in which Ms. Zalewski very aggressively and irritably responded, "No, no, I'm just trying to get things organized." I noticed how irritable and unprofessional she was in her reply, but gave her the benefit of the doubt and proceeded. She began our taxes, filling in information into the system, without saying a word to neither me or my mother. She started with my mother's taxes, and the only time she would talk to her is if she was asking for information, such as a start/end date on a job. Normally, our tax preparers take the time to look for that information on our documents, in which this lady seemed annoyed to be there and uninterested in taking the time to help us so she asked for every detail. But she never filled us in on any information she was inputting into the system. She would start calculating numbers on her phone and inputting them into the system, without saying a word to us. At one point, my mother had to ask her what she was filling in because we were left out of the loop on our own tax information. Ms. Zalewski started entering in my mother's tax information for her Lyft job. She asked my mother for her mileage used while driving for Lyft. My mother was unaware that she needed this information. Instead of Ms. Zalewski working with her professionally and educating my mother on the importance of having those figures, she made judgmental facial expressions, huffed and puffed, and acted as if she was annoyed and my mother was stupid. I sat by and watched, yet said nothing. I continued to give her the benefit of the doubt in hopes that it would get better. My mother started trying to work out the figure that she needed for the mileage while Ms. Zalewski proceeded, asking her for a figure on gas. My mother hadn't kept that log either. I said to my mother, "You don't know that either?" My mother replied, "no". Ms. Zalewski, again, turned and stared at my mother in judgment and huffed and up. So my mother started calculating it and she came up with a figure based on her recollection. Ms. Zalewski asked for receipts, and I understand that she was supposed to. That isn't the issue. But when my mother said that she had no receipts, Ms. Zalewski paused and turned toward my mother and just looked at her as if she was the dumbest woman on the planet. It was very disrespectful. She huffed and puffed, and grunted, "Well I guess we can't do mileage then!" That's where I drew the line. I looked at my mother and asked if she wanted to come back and see someone else. My mother agreed. I said that Ms. Zalewski was rude in front of her face, to which she responded that she wasn't being rude. She immediately started packing up our things and handed them to us, which let me know that she didn't want to work with us, for whatever reason, anyway. First of all, this location should have let us know that Ms. Sotira would no longer be available, not throw us off on someone else. We felt safe with Sotira and would have waited on her return. Secondly, Ms. Zalewski should've addressed us with an apology first for Sotira's absence and asked if we'd be comfortable being taken care of by her. She literally just told us we were going with her, and when we questioned her about it, she gave a rushed answer as if she didn't feel like answering us. Thirdly, a tax preparer should be preparing our taxes WITH us, filling us in on every thing he/she is doing. As an office manager, she should know this. So there is no excuse for such unprofessional behavior when it comes to such important work that could literally ruin our lives if handled wrong. Fourthly, there is no reason why our tax preparer should be talking/looking to/at us aggressively or as if she is annoyed and don't want to be there. We shouldn't feel judged. This is our taxes, and her job is to educate us on something if she sees we're unaware. She wasn't dedicated to her job. She was rude and unprofessional from start to finish, and when she saw how disappointed we were, she made no effort to fix it. She packed us up and sent us on our way. My mother and I are far from entitled or nitpicky, and we never report bad behavior. But this couldn't be overlooked. She doesn't need to prepare taxes, let alone be the office manager. Maybe she feels like she could do this to us because of her position, but we can't sit by and allow this to continue to happen. Our taxes should've been done today and they aren't because of her unprofessionalism, from the absence of our scheduled tax preparer to the blatant disrespect we received during the process. I hope this is looked into. Thanks for listening.

Dear Corporate Office of H & R Block:

My name is Yvonne Howard. I have been a customer of H & R Block for a very long time. I love all of my previous tax specialist, but today my son and I walked out of H & R Block very disatisfied. I had an appointment at the tax office of the Imperial Plaza in Clinton Township, Michigan, to meet with Sotira Rrumbullaku. When my son and I arrived at the office for my appointment, Cynthia Zalewski came out to the desk and told us that we would be meeting with her. I asked what happened to my appointment with Sotira, and she then explained that Sotira had a family emergency and would be out of the office for a while. So we met with Ms. Zalewski. Ms. Zalewski, while doing our taxes, was very quiet. I had to ask her at one point to explain what she was doing. She never explained anything (which is what I am used to at H & R Block). Also, I drove for lyft on last year but did not know my mileage for last year and I didn't have any receipts. Ms. Zalewski replied with a disrespectful attitude, "well then I guess we won't be able to do any mileage." She even turned and stared at me in a disrespectful manor because I did not have any gas receipts when driving for lyft on last year. After a while of dealing with this disrespectful behavior, my son (openly) suggested that we leave and come back later to meet with someone else. He did not want her to do his taxes either. So we left without getting our taxes prepared. Once again, Ms. Zalewski was very disrespectful and I am writing to ask that Ms. Zalewski be reprimanded for her behavior?

The following is my telephone number and email address, as well as the address of the office of The Imperial Plaza, where Cynthia Zalewski works.

My telephone number is 313-740-8777, and my email address is: yhow_rd@yahoo.com.

Cynthia Zalewski

Senior Tax Analyst

Office Manager

Notary Public

41751 Garfield Rd.

Clinton Township, Michigan 48038

586-416-2320

cynthia.zalewski@tax.hrblock.com

I look forward to hearing from someone at the corporate office of H & R Block soon.

Thank you,

Yvonne Howard

Saturday, March 2, 2019

Started by taking a picture of my W-2 on h&r block web site to get an idea of what I may receive. My son went to one of your tax office too file and when he filed everything was correct, but the picture I took previously somehow transferred my SSN to his 1040 from your cloud or something. I was not aware of this until I tried to electronically file mine thru turbo tax online. The IRS rejected my taxes due to someone filing using my SSN. I called the IRS and started an identity theft process. My son said the IRS excepted his taxes, but when he checked on the status of his refund the IRS could no locate his taxes. This is when I noticed my SSN on his 1040 form. We called the h&r office too which they recommended me calling the IRS, but I said this is your problem so we made an appointment. The tax rep called and got my son's taken care of and refiled, but mine is going to take 6 months!! I was counting on this money for fuel oil, bills, etc... The tax rep was kind enough to give me my money back(29.00 filing fee) and interest I'm losing totalling $63.00. Your office did not tell the IRS what actually happened, but said it was a type o. People should be aware that you have a major glitch in your new snap a picture of your w-2's! Now I have to get a pin number every year to do my taxes and wait 6 months to get my refund. You have no idea how much stress this had put on me and I also had to call back the state police, ss office, bank accounts, state attorney general, and a lot more to let them know it was not identity theft. Please look into your new w2 snap a picture app.

Regards,

Randall Kerstetter

Form 1040 worksheet does not add correctly for 4a IRAs, pensions, and annuities although the taxable amount in 4b is correct. I have less gross income showing than the taxable amount which potentially could cause an edit failure at the IRS.

Contacting a person using your HELP automated system seems impossible.

I have used H&R for 20 plus years and this is the my complaint.

I would like my money refunded because H&R Block has caused me nothing but a headache. Our preparer apparently cannot read numbers. He did not put in our correct checking account number and now my checks have gone back to the IRS and NYS. Not fair.

My name is Benjamin Davis I filed my taxes this year the last week in January and I had a lady by the name of Gail wasingham and I believe she done my taxes incorrectly there was a one thousand dollar difference in my taxes from last year and everything was the same I don't believe I received my full child tax credit, and she did not explain anything to me nor did she show me, your ad on TV says 2 monitors one so I can see, that did not happen , I was completely lost at the end and couldn't believe what she took time to explain to me which was the charge for my tax preparation which blew my mind $ 409.00 dollars I was stunned, and couldn't do anything about , do u realize how much of my refund that takes away from me? It's alot alot, of money I could dearly use, I am a repeat customer also, I can promise u this I will not be doing my taxes with H&r block ever again, unless something is done about this,( I know I'm just a nobody to u and your company and will never receive a response to this situation that happened to me, I have been trying for over 25 days to have someone look into this) but I guess u got what u wanted which was a huge portion of my tax return...very unsatisfied customer... Thanks.

PURCHASED H&R BLOCK SOFTWARE NOT WORKING I HAVE ALWAYS USED TURBO TAX IN PAST NO PROBLEMS CAN NOT INSTALL EASY TO INSTALL

We filed our taxes last night with Mr Frank Pickel. Mr pickel was the best tax preparer I have ever had and the front receptionist, Charlotte I think was her name, was as sweet as an as a pear. The reason for this complaint is the office manager was absolutely out of line! Mr Pickel asked her a question about one of the forms and just helping him out she was rude and just putting him down she is just an awful manager from my standing point. When Mr Pickel asked me how much of my HSA had been withdrawn Lynann Mooney got in my face in an intimidating manner saying that the IRS would ask me about it and if I cant prove that I used it for the purpose of the HSA then I would be penalized. As I was trying to recall how much exactly I had refunded to me out of the account, Mr Pickel asked us if we used it all on medical expenses. That is when Lynann Mooney pushed herself off the desk out of my face and said "I don't think she did", and she just stormed off. We then told Mr Pickel that it was what we thought was $300 when we got home we was able to find the refund amount in the email finally and it was $14.16 that was refunded to us. It was refunded last month and we have the bank statement to prove it. Had it not been for Lynann Mooney being so extremely harsh on not only us but also Mr Pickel then we could have been calm enough to have given the correct information. We was going to exchange words with Mooney before we left but she left after she treated us so horribly. We was flabbergasted when we was told that she was the office manager! Mooney has no people skills at all and in my opinion has no business being in customer service. We was so flustered by our treatment we could not even have fun in the cubical like we had been, we all just shut down after the treatment she gave us. Before we left Mr Pickel thanked Mrs Montgomery for keeping her composure during Mooney's rant. Mr Pickel was able to lift our spirits and we did end up going home to our son in a much better mood all because of Mr Frank Pickel.

I am absolutely disgusted with the h and r block in Tamaqua pa.

I was told prior to arriving ,via phone call to confirm pricing on preparation, my taxes both state and federal would come to 150.00$.

Setup an appt later that day,taxes prepared ,woman stated I owed 376$ .

I was livid. . I had no other choice but to pay this amount since my taxes where already prepared .

I then ,proceeded to supply her with the ssc and birth cert needed ,a few hours after leaving this appt I get a phone call ,bot from this preparer ,but from the receptionist,apologizing for this other woman's mistake which was that she shred up ALL the documents that were needed to file my overly priced taxes that day ..

Well I was told since I was unavailable to bring these documents to her again ,that I needed to txt the receptionists personal cell phone these doc, or she will not process my returns. . As I was getting even more disgusted, I had no other choice but to do this, even if I knew this was a security breach for them to consider this!

I found out my taxes were never filed until 10 later from the time I was there ...

I DESERVE TO BE COMPENSATED FOR ALL THESEASONS MISTAKES ON THEIR PART,NOT MINE ,I DESERVE TO HAVE MONEY REFUNDED TO ME SINCE I WAS OVER CHARGED AND FALSELY GIVEN THE INCORRECT AMOUNT ,PLUS breach of privacy having to send doc via a person cell phone .!

This needs to be corrected !!!!!!! Like 2 weeks ago! Thank you

I made an appointment for Sunday 2/17/19 at 4pm (and there was also an option to schedule for 5pm).

The Friday before my appointment the office called me and requested I drop off my paperwork in order for them to expedite my process and be ready on Sunday. While on the phone they consistently asked me to change my appointment to 2pm or 3pm. I let them know I could not because I work. “IF” I got out of work on time I could possibly make it by 315-330pm but I prefer to keep my 4pm appointment to be safe. The lady immediately said ok perfect I will schedule you for 315pm. I again repeated myself and let them know I wanted to keep the 4pm appointment. They said I could not keep that appointment because they are closed at 4pm. I let them know the website offered 5pm, why would it offer 4pm and 5pm appointment options if they are closed and 3pm is the last appointment. She stated they only stay open that late if they have clients. I asked am I not a client that will be there at 4pm? She soon dropped the topic.

I took time off work and dropped off the paperwork. While at the office they told me again the issue with having a 4pm appointment and were again trying to force me to change my appointment. I again let them know 315-330 is earliest I could make it IF I got out of work right on time and there was no traffic. She said ok. I left my paperwork and less than 10 minutes later I received a text message saying they were confirming my 3:00pm appointment. They changed the time even after I told them not to.

I leave early from work to get to the office on Sunday at 2:55pm fearing I will miss the new appointment time and have my appointment canceled.

After waiting at the front desk for 3-4 minutes before someone came to the front, I let the person know I was there for my 4pm appointment. They said “it’s only 3pm”! I rexplained the entire situation and they said they will have to see if someone is available to see me or not.