Chase Bank Complaints Continued... (Page 3)

239+ reviews added so far. Upset? Call Chase Bank corporate: 1-877-242-7372

Bank teller at Burbank, CA First Street, Branch 740808 was very rude to me. Instead of explaining properly the procedure on how to deposit and cash the check he just blatantly told me "I don't need this withdrawal slip!". He also raised his voice and ask me "What do you want me to do with your check? Very rude! He is a tall guy and his name is Patrick this happened on 3/26/15 @ 10:50 am in Burbank, Ca.

I have been a chase member ever since I was born. The fact that you are making chase inexcessable to windows phones really irks me. You are really giving in to the man, and frankly that sucks.

Chase has been making a lot of bad mistakes in my checking account ever since I got my wallet stolen last year on December 15, 2014. Recently they took out an amount for a purchase twice of $7.40 and have not credited it back to me. I am sick of their mistakes, and they won't stop!

11/17/2012

I am getting very tired that Chase keeps calling my home number asking if so and so is available. After explaining a minimum of 12 times in 3 weeks, I am getting extremely irritated that no one at Chase has a brain in their head . If I give them ny telephone number and last name and it does not match what is in their records, I feel that the next step shoul dbe a Class ACTION Law suit for undo harassement....

Please remove my number from your system if not - the problems that will arise are on your head................

I went in to my chase branch in Clinton Township, MI and made two deposits. They were small deposits that totalled no more than thirty dollars. I knew that i had paid a bill for twenty seven dollars and some change. I had a little over seventeen dollars left in my checking account. The personal banker was using a teller's computer but he kept going to the back into another room. I asked him why did he keep going into the back especially after I gave him money.

He said the computer wasn't operative and that it wasn't his. The teller that used that computer was on lunch I assumed. I have seen her many times and I have even went to her before. I felt something was wrong but I went to this personal banker before because he straightened out a NSF check a month ago where I did not receive a below deposit alert. I did not receive a below deposit alert this time either. These alerts are to alarm you when your balance is low. I am suppose to get alerts when my balance is below fifty dollars. I even changed my alert to checking account not getting below one hundred dollars.

This personal banker printed me out a receipt that said bank inquiry. It looks just like a deposit receipt. How clever was that on his part. I received one just a month ago and did not look at it until this problem occurred. This is a trick and or scam that is new to me. I want to alert all customers and remind them to look at their receipts before leaving the bank. There is no transactions on the books because it is as if I did not deposit any money at all.

My proof is that I have the inquiry receipt and I had a inquiry paper printed for my records. Even the printed inquiry receipt has another tellers name on it. The teller who uses that computer was the name that was on the inquiry receipt and paper. This is a sure way to steal money from your bank without the bank ever knowing it was you or seeing anykind of fraud. Banks beware.

This Has been happening for the past 4 day Zoom.Com.Is taking 974.99 each day.And Chase is no doing NOTHING about it.I have been to Chase 3 times this weeek.And they Have NOT done nothing about it.And my Money keep disapearing from my account.Please HELP.

Several years ago, we received a check which we deposited into our agency's corporate account at the Chase Bank on 63rd and Western. We did not know that the check was fraudulent. We were told by the bank that the check had to be referred to the Maker. Chase Bank normally clears check like the one we deposited in seven (7) busines days. For some reason, they cleared the check within 48 hours. We had written post dated checks on the account.

Some of our employees took the checks to the local currency exchange to cash their checks. After the 2nd day, we found that Chase had "cleared" the check - so - we wrote checks to cover our agency's gas, electric rent, casble and such other normal business debts. Never once did we seek to take a substantital amount of money from the bank. We assumed that the check had cleared and that everything was okay until the 5th day when Chase stopped the checks. As it were, out of a $15,000 check, we only paid out $6,000.

For four years, we have been without a checking account because of this matter. Haven't we been punished enough? Chase Bank also turned the account over to the collection agency. We need someone from Chase Bank to look into this matter and bring this matter to a close. We desperately need a corporate checking account. We are writing proposals and there is an excellent chance that we will receive a $50,000 grant within the next three months. Additionally, we pay extra fees at the local curency exchange for cashing our corporae checks.

Is there someone that can help resolve this mattter? Chase Bank nevr formally accused us of defrauding the Bank. To this day, we simply deposited a check that we received for what we thought was a donation - nothing more and nothing less. If we were attempting to defraud the bank, we clearly did a piss poor job of doing that as we paid bills and did not draw down any major money and run with it. This should tell Chase Bank something.

Hi I have an account on chase bank which is frankfort Il Colorado Ave.

It is near my home so I choose your bank.I am not satisfied with service .

When I was eligible for card that took more then four month to deliver.Every time they told me that I will get in mail in seven to ten days and when I didn't get it .I had go to bank again and every time they told me it is the post service .I alert post office too .Finally I got it after many visits.It was waste of time ,gas energy anf frustating.I gave them benefit of doubt that may be it was misplace by post dept and did not complain

Again they show their service when I ordered for my checkbook . I had to order check book whiich I did in last week of Jan 2012 and the date before 27 .I was told that I will get in seven to ten days. Chase bank was Late as usual for service .

I made three trips and today is 16 and still I did not have my check book. I want that they should give us good service and as being late in their service not one time but twice,they should give me some penalty. I am thinking to go back to my previous bank which was one mile away but had better service. Instead of talking they should work and show some efficiency

Chase contacted me in Dec. 2011 about suspicious activity on my acct. At which time my debit card was cancelled and a new card issued. In Feb. 2012 I went to use my new card and the transaction was denied.2 months after the initial card was cancelled the same company was allowed the charge $2000.00 plus dollars. Now 3 days later I'm disputing the charge. Howcome a company was allowed to use a card that was cancelled and no longer valid 2 moths later. I'm furious. And have no access to money. The next step for me is to hire a lawyer to sue Chase Bank for not complying to secure banking as prpomised and the company who made the unauthorized charge.

I am told they are waiting on a sales report; from a company whom don't have authorization? I will be waiting forever. This is the worst service and experience I've ever had. This error shows how incompetent your business is. It's common sense that a bum would undetstandx if a card is cancelled, it shouldn't be used. Period. Why does Chase Bank not get it?? Card cancelled 12/2011, charge 2/2012. What's wrong w that picture?

As good business it should be considered to implement an operational procedure that monitors the updating of your website to include only active locations. Your north Dale Mabry location in Tampa is now a Chase bank, but is still listed on your website. Poor operations as this should be a relatively simple task for an organization as large as yours.

In Sept of 2008 my contracting business was very slow and I fell behind 4 payments on my lake home. I contacted my lender, Chase Bank and explained the situation. I requested the modification and the manager at that time put me on a 3 payment "Trial" payment of $1800 a month, $650 more than normal PLUS a $5000 downpayment. I thought this was odd but never having done this before I agreed. After scraping up the down payment and making the 3 payments I was then placed with another manager. This one told me that things had changed and I would be required to make a $2500 down payment and 5 payments of $1200.

By this time I was very leary but this was my lender and I didn't know I had any alternative. After these payments were completed, I called to check on the process I was again placed with a new manager that informed me that the Obama law was in affect and that Chase did not require any further payments and that my modification should be forecoming.

That was October 09. At that time I was only 4 payments behind. It is now November 2011 and I'm STILL awaiting my modification but now I'm 27 months behind and my home is and has been in Foreclosure status. I have sent so many "Request for modification packets with updated bank statements and documents that I'm worn out. I now think Chase is a total scam but therre is no where to turn. I just wait on news that they are foreclosing on my home and they didn't do a thing after all the required money was paid and no credit was given.

The actual investor is Wells Fargo. What ARE they waiting for?? By this time Chase should just offer me a low interest rate modificaition and let me get back to my normal monthly payments since they have SO many homes to deal with. I NEED HELP!

My husband had an account wth Washington Mutual but they merged with Chase. Chase sent a letter to my house claiming that unless they hear from us, they will transfer the money to the State for being inactive. I just found out about this when I received a 1099 claiming a distribution money that I never received. I went to the Chase and asked them to correct this mistake and re-open the IRA account. They refuse to do it. I ended up payting taxes for money that the state still has it. Chase bank has closed my IRA without telling me, and it's caused all kinds of problems. This scam has to go stop now.

I've been a Chase customer for many years, with thousands of dollars in accounts all over the place. It's not reason why they can't go into my account and clear up this mess, my money is literally depending on this. I called their customer service phone number, but got nothing but frustration in return. How else am I supposed to fix these problems with the taxes coming in April. The money still is in there, even though the letter says otherwise.

I'm a Realtor in Aliso Viejo CA. I've been hearing an ad slot on the radio in which Chase Mortgage promotes their mortgage website as a "One Stop Shop" and there is no need for a Realtor. I'm letting you know that I have tremendous influence over the Mortgage companies used on my Listings, and my Sales.

As long as these ad spots run I will do everything in my power to discourage everyone in my personal and professional life to stay clear of Chase. I am also in the process of bringing this concern to my local real estate association, the National Association of Realtors, and the California Association of Realtors. If you don't value Realtors you're going to find out what it's like when they don't value you.

I recently lost my check/debit card and closed it. Let me say that I 've had this account for over 20 yrs. Up until yesterday I was extremely satified. Doing what I thought was right after loosing my card I closed it. Needless to my surprise, my rewards points which you no longer offer were wiped off with out any notification.

I had been holding on to these points for this holiday gifts. Not knowing my balance I spoke to YOUR represntative and explain if I didn't know the exact amount. 4300, 43,000 I don't know and stated that. Well, reviewing my account yesterday I notice a strange credit of $43.00 deposited on 12/07/12. So after contacting you, I was told there was nothing that could be done. THIS IS UNEXCEPTABLE!!!!!!!

A disatified customer who is looking at other banks!

My husband and I bought a home in north Carolina, the loan was in my husbands name as he didn't need me to qualify because I was unemployed and a care giver for my mother. We always made our payments on time and in fact we usually paid a month in advance. My husband died and I notified the mortgage dept but they would not talk to me or give me any information because I was not on the loan. I sent 4 death certificates, sent many letters trying to get them to help me but they refused to talk to me for confidentiality reasons. I faxed the death certificate and mailed the other copies to multipal depts. but they still would not respond. At that time Chase offered financial assistance and sent an application addressed to my deceased husband. They would not accept it from, still because I was not on the loan. I was so frustrated and angry because NONE of the parties answering the phone would forward me to a manager or supervisor. It was a slam dunk, you are not on the loan, we won't give you any information. The idiots were not able to figure out that talking to my husband was impossible and offered no help what so ever. In the meantime I had the house listed with a realtor who had a potential buyer and chase foreclosed on my house.

In the state of north Carolina if a spouse dies it automatically goes to the survivor and I was on the deed and they still would not talk to me. They had a "canned" rehearsed statement about the privacy act which in my case was carried way to far. It was my retirement money that was applied to the loan and we paid on the house for 7 years so I lossed all of my money in addition to the years of payments. Six months after my husband died I was hospitalized and was sick for 2 yrs and I gave up and never received any money from the sale of the house.

Chase is very unprofessional, lacks common sense and as far as I'm concerned failed to do their duty in assisting me. Yesterday I was in a chase branch and told the employee what happened and he made a stupid comment that maybe my husband didn't want me to have the house. That was the ultimate insult. I hate Chase and I'm glad they got sued for illegal foreclosures and hope they that continue.

When did people start loosing "common sense"?

I love how Chase has singled out an entire group of mobile phone users. I am relieved that I switch to a credit union before this happened on top of the fact you have no offices in upper Pennsylvania or lower new York area. I think everyone should switch to a credit union just for the better personal service and lower costs in fees and other services. You, Chase bank can be replaced with a plethora of other banking options an i hope you lose a lot of customers due to your stupid choice.

Even after discharged bankruptcy Chase Bank Willoughby, OH branch continue to write letters to me regarding continually accruing charges for a small safety deposit box awarded me by Chase Bank for opening up an IRA back in 2005. As my finances dwindled during the recent recession, I closed my account and eventually mailed the keys back to Chase who promptly returned them to me saying that I need to come in their office to sign papers. I will not return to their office to sign closure documents that can be mailed to me the same way they returned the keys to me. Charges are continually accruing even after my bankruptcy and attempt to return the keys. I feel threatened, harassed and frightened by their aggressive collection behavior. There is something very sinister and unsettling about a huge financial institution devoting so much time in constant harassment over a non-issue that could have been resolved by their acceptance of the safety deposit keys.

It is very hard to say this, but my father Frank Fanella is a deadbeat. He is always making up excuses. I am grown now, but my mother, Claire, is still raising my younger brother and sister and is facing foreclosure now. Now, my father is getting into dope dealing with another black sheep of the family Dominic Thompson in Florida, who has already been convicted. I don’t know what else to do to stop this insanity.

I opened Chase account for the sole purpose of depositing funds into my out of town student’s account. This account was approved by Chase Bank customer service for our plans. That was just 2 years ago now a new Chase Bank rule no cash deposit unless a signer. If ever there was a Bank rule that caused unnecessary delay in available funds for our student it is this rule. I guess they don’t need our business. Smart of a business to cause hardship for us working people.

I am a “homeowner” with a mortgage through Chase Bank. I am writing this letter with no real expectation of change but with a need to express my experience having a Chase Mortgage and to determine if I am a customer who has been singled out and persistently mishandled or if there are others with similar experiences to mine. I am attempting to determine if the policies and best practices of Chase are flawed or if they have been deliberately used to harass me. Hopefully I can explain my frustrations in a way that will allow the person or persons reading this to offer at least an explanation if not an apology.

I will begin at the beginning. In 2001 I was granted a 30 year fixed rate mortgage. I had a husband and two children and two incomes. In 2005 my husband was fired. I was making partial payments not realizing that none of the payments were being applied to the mortgage until I received a call notifying me that I was 4 months behind on my payments. “By the way we do not accept partial payments”. After many forms and phone calls later I was granted a forbearance which in fact made my payments higher. The Homeowners Assistance Dept. was rude in their phone conversations and unreliable when receiving faxes and paperwork requested by them.

Entire files had to be resent due to their claims that they were never received. All payments had to be made by certified funds. The representatives were impatient, uncompromising, and mean when attempting to explain to me how this higher payment was helping me. While dealing with this issue I called or was transferred to (800) 446-8939, (614) 961-3196, (800) 848-9136, and many other numbers to various departments and fax machines. In 2007-2008 I had to begin the whole process again after going down to one income again. Just like before my “help” came in the form of a much higher mortgage payment. For 18 months I had various handlers or negotiators.

I went from a 1500 dollar mortgage to an 1880 dollar a month mortgage. Again I was asked to send in mounds of paperwork that was lost or misfiled more than once and transferred to different departments, placed on hold for 20 minutes or more, disconnected or told “your call can not be completed please hang up”. I was told on more than one occasion that unless I could refinance there was nothing that could be done. Meanwhile as you are making payments according to the “forbearance” on time, with certified funds, you are reported to each credit bureau, every month, as late on your mortgage payment which has been devastating to my credit rating, and also making it impossible to refinance.

For two years, even though I was making the higher payments on time, I was reported late. In 2009 The NACA convention came to my area. I was having a very hard time making the payment each month and I thought there may be some help for me. I gathered up every tax form, paystub, teacher contract, bank statement and every other piece of paper, waited all day, and watched as the bankers from Chase turned each and every homeowner away. In September of 2010, back to a single income again, I applied for the homeowner’s assistance program. I began the process of calling. Each day I got new relationship managers such as Sharon Keys and faxed paperwork.

Everyday I would call to find out what else they wanted such as proof of address, letters stating that my husband was not receiving unemployment. Re-faxing documents every day for various reasons such as box C wasn’t checked on form 4506T. At one point the process was taking so long I had to fax in more current bank statements so that the most recent months were represented. After all of this I received a form letter informing me that I was denied. In that letter it was suggested that I attempt to refinance. As you may know it’s the policy of Chase that if you were behind by 30 days within the last year you are not eligible to refinance your mortgage.

Chase had reported me as late for the entire 18 months. In March of 2011 my divorce was finalized. Throughout that process I was 3 months behind on the mortgage. I began again the process of gaining a modification. Weary from the last attempts I began by gaining a transfer of ownership since I received the home in the divorce settlement. I received the packet in the mail after 3 requests. Completed the forms, notarized and attached the one hundred dollar check. I also requested at this time that my name be changed. I attached a copy of my divorce as well. Immediately I began the follow-up calling after the return receipt came in the mail.

Initially the person I spoke with had no record of the information I sent. After the check cleared the bank I received a letter stating that they were unable to remove or add party on loan. They also would not be changing my name on the loan. I began the phone campaign to speak with someone. I called (800) 848-9136, (800) 548-7912, talked to Brandy (her real name? maybe), (877)314-6359, talked to Ebony Williams. Still nothing on the name change. Meanwhile I am applying for another modification. I called (866) 282-5682, (888) 404-4674, (800) 848-9380, (888) 353-1842 and got to Robert at ext. 322057 who listened and was extremely helpful. He basically talked me off the ledge. I faxed everything to Robert and was miraculously approved for a trial modification. Like a ghost I have never been able to reach Robert again.

Now I am on the modification, my credit is still taking a major hit, and a hail storm puts several wholes in my roof. My insurance company is contacted. They promptly send out a check to me, and you guessed it, Chase bank. Theoretically I could go into any Chase branch to have it endorsed. Wrong. This is Chase bank. They won’t endorse it because I am “behind” on the mortgage. I have to send it in with, you guessed it, a packet of notarized forms. I call to request the packet and it never comes. I call to ask what happened; they give me a website to download the packet. I download the packet send it in with the check.

I call some more numbers and departments to find out that they have rejected one page of the packet because I have “Chase” written where my name is supposed to be written. In the mean time a month has passed and I still have a tarp on my roof. If you’re getting tired of reading this then you know how exhausted I am living it. Every time I call they refer to me as Mrs. Sowell. Not my name. Every paper they send to me has my ex-husbands name on it or requires his signature. He doesn’t live here or have any claim to the house. I can see why people just give up. There seems to be no end in sight with this bad romance I have with Chase Bank.

There is no one “in charge” to complain to and no department who has any clue what the other departments are doing. No phone numbers that get you directly to a person who has any idea about what’s going on with your case. I am frustrated by all the red tape, the bureaucracy, and the bouncing around from person to person and department to department. I am frustrated by the endless hoops that your best practices cause honest people who are trying to do the right thing to jump through. All of this brings me to my original question: Am I being targeted and harassed or is this just the common practice of how Chase Bank operates?

My daughter has also had trouble with Chase and from the beginning I told her not to do business with them, cause they were so inept when we were selling them the house. They kept calling me every other day to send more information and payoff information and they already had it. You could never get the same person twice and they seemed stupid to me. Now after she has paid them on time, they reported her to the credit bureau and threaten forclosure on them. They also said the money went to a different account. She has proof that it has been paid and faxed them the information, in the mean time she is a basket case and it is challenging her health.

They have gotten help from the government and I thought the Bank’s could not take advantage of the average person, my daughter has had credit problems in the past and they know this and have intimadated her now because of her past problems. They are certainly some bank to stay away from…..they have a license to be a crook…………..She hasn’t got the money for an attorney and now that they have ruined her credit further, no bank is going to consider her for a loan….Help please with some answers…

Chase froze my account for $10,000,000 meaing they put that against my balance, after a poor conversation I had with depost review. The conversatoin was to discuss the fact that all the sudden my pay check was being held out of the blue for some odd reason. They said the account will have the $10,000,000 hold against my account until the check was verified. That is absolutely insane and extremely cutthroat. Chase Bank is the WORST!

I have a print out of my account from 06/27/11 and it has everything on it that is on the print out from 06/28/11 except now the balance is $1.15 less. I’m wondering if there isn’t some fishy business going on in the computer systems. I complained by phone today and they of course “don’t know what to say” is their response. Then they try to tell me to “keep up” with my account better by keeping a check register. My reply is it apparently doesn’t matter how I keep up with it if money just grows legs and walks out of my account. I have been calling regularly since March on my account because my online balance hasn’t been matching up with my personal one on an extreme regular basis.

One day it says this is your balance and the next it switches with no new transactions just a different balance. I even stopped purchasing, when I can, by credit and doing straight debit so transactions will post that day and not carry over for three days. RealCash isn’t even worth it anymore because Chase can’t even keep my money caged where it belongs.

To Senior Management of the Chase Banking Corporation, I have been a Chase Bank customer for over 1 year. I have always done most of my banking at the Chase location in Yukon, Oklahoma. Almost a year ago I was injured on my job and started receiving workman’s comp. insurance payments. These payments were issued through my attorneys office. When my checks first started was when I first opened my account. Prior to opening the account I verified with the current manager at that time (Bryan) if I would be able to deposit the checks, he stated I would, so I opened the account.

I deposited the checks without any problems for about 2 and a half months, so around 9 – 10 checks. The following week I went to deposit my check and the clerk (Melissa) assisted me. She would not take my check. Stated they could not deposit the check. I explained I just wanted to just deposit it not cash it and that I had been bring it here for over 2 months. I again spoke to Bryan and he deposited the check. I wanted to give you some background on this issue. Since then I have been inconvenienced for a year now with cashing and depositing my weekly checks. I have to take them to a different bank, pay a fee, cash it, drive to the Yukon location and deposit the cash.

This is and has been ridiculous, but this correspondence is in reference to my experience today 20 June 2011 at your Yukon, OK location. My attorneys office, as of today, is no longer issuing letters with there weekly checks, and they would be contacting the banking facilities to inform them. First of all they called the facility in Yukon, OK eight times and they never answered. I waited in the lobby for almost 30 minutes while this took place. When they finally answered Melissa’s excuse was that they were a small branch and they couldn’t get to it. When Melissa spoke to me a Chase customer she was very rude and her tone and condescending statements were very disrespectful.

She didn’t stop there, when she spoke to my attorneys office she was just as rude and disrespectful. She was rude to the point that they requested the number to the corporate office and she refused to give it to them. I asked what can we do to fix this or who we needed to talk to because I didn’t want to open another account at another bank just to deposit this check. Melissa stated well you have to just do what you have to do.

The Banking Industry is not just dollars and cents, a very large part of it is customer service and customer satisfaction. I understand Melissa is the new Branch Manager in Yukon, OK. I am sure she has cost your company customers and their business. Melissa desperately needs additional training in the customer service area. She is also very rude and very unprofessional. She has no people skills that were evident. I can’t comprehend how she could be an effective Manager. You may have good employees suffering under Melissa’s lack of leadership, and Managerial skills.

I would appreciate it greatly if someone from your office would contact me in this matter. Thank you in advance for your time and assistance.

Sincerely,

Lupita Smith

I went into Chase Bank to meet with Investor about investing $50,000 in C.D.s but they decided to invest my money in an already stock that costed me $2,800 in less than 2 weeks. Tell me what kind of crap is that, they put my money in a stock that was knowingly failing and worth crap! If I wanted to gamble I would have gone to the damn Casino. Chase should refund my money as a courtesy of being a customer for over 20 years.

Recently I got several charges on my Chase debit /checking account on May3,5, and 6th of 2011 and I went in to my home branch to talk to a Banker about my account. She gave me their Dispute Claim number to call which I did and they told me to call the merchant number on my bank statement first I did that and it was Yahoo.com they asked me for my full account number so they could handle it for me. Initially I had 3 charges of $19.99 from yahoo and $34.00 charge from Match.com and I never did business with these people at all!

Chase reversed the charges from them all but decided to reverse the credit on one charge back to the merchant for $19.99 7 days later and I called to complain about it but the dispute person was rude and sharp to the point that Chase decided to give that amount to the MERCHANT and I recieved no product or service! Now it has thrown my account into overdraft of $34.00 and an additional $15.00 for not paying it in 6 days! I am livid and about to close my account with Chase Bank!

I received an automated text message from Chase Bank telling me to activate my new debit card because my current debit card is going to get cancelled on June 7th (the cause of which was because my account was one of those compromised by them -NOT ME). Firstly, I never got this so-called replacement debit card at all. (I never throw away my mail, even the junk ones from the beginning of the year to the end. I always get rid of them by taking them to a shredding event at the beginning of the next year). According to the Chase representative I talked to, it was supposed to have been sent on the 15th of May and I should have gotten it within a few days after that.

Well, I didn’t! She then proceeded to tell me they could send me a new one and just charge my bank account a $5.00 fee to rush it and get it within 2 business days, whereas, if I go through the “no-charge” route, I will just have to wait 5 – 7 days to get my debit card.

I was recently flooded. Chase bank holds a very small 2nd mortgage on my house and GMAC holds the principal mortgage. Chase is trying to say they have a new policy in place where everyone else would sign the FEMA check and they would deposit it, hold it and issue it to us a little at a time. I had to pull money from my 401K in order to pay for the flood damage up front and this is my reimbursement money that has to go back into my 401K. How in the world can Chase Bank get away with this?? Who makes up these stupid rules and where does one get protection from them? It’s not their money, it is mine.

For over a year we have been trying to have our loan remodified with Chase Bank. My husband and I were out of work for a few months. Both working now. Chase continually would say they were going to remodify our loan. We would send in paper work they expected time and time again they would lose the material or have a different worker on the case. One minute they would say we were approved and then send us a statement saying we were denied. You talk about being a yo yo. My husband and I finally put the house up for sale trying to stop foreclosure.

They say we are in the short sale department, but whenever our realtor tries to get in contact with them to set up the short sale they get the same run around as we did. I have never heard of such a confusing bunch of people. The old saying the Left hand doesn’t know what the right hand is doing is definately true with Chase Bank.

We paid mortgage payment on time since we got a mortgage from Chase, which is last 6 years. Last year by mistake the check went to different vendor and they cashed it. Chase never informed us that they never received a mortgage payment for a month. They send us a regular statuement following month with due for 2 months as well as late payment. We send them copy of the check that check was cashed. After Chase assured that they never received a check, we paid them before the due date all money. However, Chase reported to credit bureu about late payment. 1 late payment in last 6 years of loan.

When we called them bank representative informed us that they will fix it but nothing happend and we send them all paperwork twice. Chase is nothing but scam.. BEWARE…

this is about jhoanne bernal, first left no information about the irs situation and my bank account went into negetive money. was there and chase has no record of the conversation we had about the money being in someones account and then transferd to mine. its fine it goes back i have to wait 14 days plus mail time and a 140 insaficaiant fund thats not right it is what it is. all i wanted to know today was if the money had cleared in my chase bank account or what happened and i spoke to mary j aynes very simply i have never had a person in her position talk like that in my life.

go back and listen to every lie and you will know that some day it will bite you in the foot i will say no more but chase now will never get any lump sum of money from me to do business. you can have enough to pay my light bill.

To: Chase Bank / Mortgage Department March 30, 2011. In late October of 2010, I purchased a new house insurance policy with Allstate, the representative need some information on the property and requested that I call and talk Chase Mortgage Co about the changes. I was shocked to hear the following message: Your payment for October is past due! I immediately call the mortgage department and talk with an associate from that department, he said not to worry, Chase allows a person to be one month behind and this is how Chase will handle the late payment.

October would be excused and November payment would be the same as previously paid. However, December’s payment would be $3600.00 plus dollars and January’s would be approximately $2700.00. He stated that this would not AFFECT my credit and asked why the payment was not received as scheduled. I told him that I rent the property out and the tenant always paid on time and with that I explained that my daughter had passed away in June of 2010 and left behind 5 children and that my wife and I needed to help with until all was settled. My daughter lived in Wilmington, Ma. and we live in Colorado.

As I have already explained the tenant always paid, so I did not pay any attention to the mortgage as my mind was preoccupied with the tragedy at hand. In November, I received a statement from the mortgage department requesting a payment of $4300.00 plus dollars, I asked them why, would you be expecting a payment of $4300.00, when it already has been agreed to pay the regular amount in November and the December and January payments to be of the larger amounts, and this would satisfy the loan.

The lady I talked with started to ask me questions about my income and I answered all the questions that she requested. At the end of our conversation she said I will set you up under this plan. Pay the regular payment for December and in January, February, and March you will pay $2860.77 for the first two months and $2799.08 for the third month. These conditions have been met. However, along the way I was charged for two payments in November as my bank statement will reflect and I had to fight with the mortgage department to get one payment put back into my account.

Secondly, I was told repeatedly that I would receive papers to apply for the modify mortgage program, after calling a number of times to ask for the paper work. I was told that it was sent out, and another set of papers would arrive at my house in 5 to 7 business days. To date this has not happen. I have received at least 6 documents stating that I am in default and that there is a modify program and all I have to do is request this. Well I have, and the only thing I received so far is a notification from the Post Office is to pick up a copy of that which you send me every week (default statement). I have kept all that I have received from Chases Mortgage department and I have been in earnest pursuit of an attorney to see if I have just cause to sue for harassment and also will request that any late payments that show up on any of my credit scores be expunged.

Enclosing, I feel that all the penalties that I have had to pay as part of a late fees on the mortgage should be reimbursed, the opening statement, back in October, when I was told to pay the amounts addressed and the fact your representative stated that my credit scores would not be affect, have in fact been. A closer look at this issue has caused my credit card limits to be substantially reduced.

Again, I believe that I have been misled by your representative(s) and have paid far too heavy of a price for their actions.

Yesterday i was unnecessarily triggered into a sympathetic empathy from my personal banker at Chase bank. The business being discussed by myself and a Chase Bank personal banker, were interrupted by a bank officer. Two days before yesterday , April 7th. My personal banker had ordered my checks to be mailed to me in care of the Chase Bank @ Central & Green Bey Ave. Evanston Il. My personal banker permitted the check delivery to me at the bank, because of my personal special needs. The bank, lady director was in my personal bankers office and over heard my question, ” STEVE ARE MY CHECKS HERE ?”

” You are not permitted to order checks to be mailed to the bank” the lady bank officer said to my personal banker. I was embarrassed, my Personal banker was reprimanded in my presence. Prior to this experience, I held Chase Bank in high esteem. Your apology may help me to resume my good opinion of my Chase Bank. Sincerely Yours, Rev, Dr. Chandler.

I went on line to fill out an application for a Chase Freedom credit card and noticed that by filling the application on line as opposed to filling out the mail copy and returning it my variable APR after march 1,2012 is 11.99% and 9.99% on the paperwork I received in the mail. I don’t like being told one thing and then having it changed when making application for the card. Please DO NOT send me any other offers from Chase. Sincerely, Betty Alm!

I ALWAYS make my mortgage payment via online banking. For Dec and Jan the payment was rejected by Chase for no valid reason. My bank (BofA) noted Chase did not accepted payment. Because the money was taken out of my account, I assumed it was paid. I received letters claiming my mortgage was in default. As soon as I was made aware, I paid WITH FEES the 2 months balance. It has affected my credit. BUT BUT BUT, here is the kicker. The SAME THING HAS HAPPENED TO A CO-WORKER OF MINE. It was in Dec. and he is at risk of loosing his house because the Chase payment was not accepted. I thought it was a fluke with me, but now I think it’s a scam Chase has to collect additional fees!

I had 87.42 taken out of my checking account by chase bank and I didn’t request it because I am on social Security and can’t afford it. I didn’t expect this from a bank like chase (which I trusted fully with my money) but they still have no idea. I have called their 1-800 line and tired of getting placed on hold for hours with incompetent fools! Please give me back my missing money and put it in my chase bank account or you will be hearing from the better business bureau, which have already been notified!

An open letter to Chase Banks and Chase Banking worldwide. I don’t care much about the inconvenience. Nor do I really care about the overdraft fee very much. What I do care about is being lied to repeatedly and the holding of funds for no reason. I have been through quite a bit with this bank, and am tired of them holding funds, rejecting transfers, and charging me wild random fees left and right. I have almost had enough, and will probably switch banks soon. The overdraft fees really bother me, but at least if chase would work with me I wouldn’t care half as much! It’s the fact that they are incredibly rude and customer service could care less about us, the consumer!

We tried to get a loan modification with Chase bank last year, handling everything ourselves. They “lost” our paperwork four times and then eventually denied our modification because they said we didn’t make enough money. We started the loan modification process again with Chase bank in early 2010, this time we hired a loan modification specialist to help us. Again Chase has continued to “lose” our documentation. They denied us again because they said we hadn’t provided all of the necessary documentation. We have proof that we did and had to file an appeal to reopen our case. We still have not received our loan modification or any information regarding the status of our case as of today.

Opened a Chase online banking account in July 2009. Last transaction was posted Aug 2009, but here’s how it went. I called in March 2010 to close account while still in free promotional period with a positive balance of approximately $3. I thought no problem everything should be fine. However, there was no correspondence until today, 9/23/10, when I get a letter stating they are sending my account to a collection agency for $46.83 due to under-balance fees and overdraft charges. The overdraft charges for the under-balance fees which should never have been levied in the first place. I had called chase customer service to discuss the issue and alert them to their system error.

I was then informed that I should have visited a branch and spoken to a manager to confirm that a $3 account was closed. Are you kidding me? What a joke Chase! They “forgave” the $20 overdraft charge because I was upset but are still sending the account to collections for $26.83 unless I bring the account to a zero balance within the next 10 days. So basically they’re threatening to hurt my credit rating unless I give them $30 they never had any right to. I will NEVER do business with Chase again and will strongly advise everyone I know not to either. I don’t understand why people make such a big deal out of nothing, is it really worth the fuss over a few bucks!

To Whom It May Concern:

On August 29, 2017 I called in to let your company know that my debit card was ran twice at Americas Best Inn hotel for $70.22. At that point, the costumer service person told me that he will credit my account of $70.22. I was NEVER told that is was temporary. Now mind you, I check my account statement on a daily to make sure I am not overdrawing my account. On September 12, 2017, I looked at me account and it was overdrawn. So, I called customer service to ask why my account was overdrawn and I was told that I was credit it twice for the $70.22. I told Anne that no I was NOT!!!! She states that the merchant gave me a credit on August 29, 2017 and Chase (your customer service rep) also credited me account. I So, responded to her, No they didn't cause that credit was not on my statement at time. So, I asked, if the merchant supposedly gave me a credit on August 29, 2017, why would you give me another credit on September 1, 2017? If that credit was already on my account you would a notice that credit on the day? And she (ANNE) YES!!! If the credit your account on August 29, 2917 we would have NOT gave you another credit. After Anne said, that, Anne refuse for me to talk to her supervisor. I am very upset on how this situation was handled. I never know for a bank to treat their customer this was especially the ones that were effected by the storm. I also, have proof that the refund was not progress from the hotel until August 31, 2017 because it could not be done until the manger was back in the office and she didn't not get back in the office until August 31, 2017.This was handle in a VERY POOR MATTER!!!!!!

MY FAMILY AND I HAVE BEEN BANKING WITH CHASE FOR YEARS. THE SERVICE AND THE BANKS SYTEM OF KEEPING CUSTOMERS IS NOT UP TO STANDARD. I HAVE TAKEN LARGE AMOUINTS OF MONEY OUT OF MY ACCOUNT FROM CHASE AND ENTRUSTED ALL MY BANKING NEEDS WITH A BANK THAT SURPASSES CHASE BY 110 PERCENT. MY FAMILY HAS TAKEN THEIR FUNDS ELSEWHERE AND CLOSED THEIR ACCOUNTS WITH CHASE. CHASE BANK IS A LEECHING ORGANIZATION AND WILL NEVER GET ANOTHER DIME FROM ME. I TRANSFERRED FUNDS INTO MY CHASE ACCOUNT TO COVER SOME BILL PAY. THE NEXT DAY I WAS HIT WITH THREE 34.00 OVERDRAFT FEES. THIS IS RIDICULOUS AND I EXPLAINED THE SITUATION TO A CHASE REP BUT OF COURSE NOTHING CHANGED AS USUAL. I'M APALLED BY THIS ACTION AND I WILL NEVER DO BUSINESS WITH THIS LEECHING INSTITUTION AGAIN. CHASE IS FILLED WITH BLOODSUCKERS AND WE WORK TOO HARD TO ALLOW CHASE TO TAKE ADVANTAGE OF US. GOODBYE AND GOOD RIDANCE.

I applied this am for an Amazon visa to get a 70.00 gift card...I IMMEDIATELY realized I would not receive rapid on line approval which occurred...Then indicated further review of application would be required...I absolutely do not want a further evaluation and certainly do not need another credit card! I then called a chase representative and supervisor and told this process could not be deleted..really?? And why not...Chase has all my pertinent info and when "further evaluated" by an analyst why can't it be deleted by request of customer at that time?? I do not want a negative mark on my credit report and cannot fathom why this is not doable..I am a retired veteran with a fixed income and of course I will be denied..I made a mistake and am asking for assistance in rectifying this problem. Certainly SOMEONE can intervene and eliminate a negative remark in my credit report!! Would appreciate assistance, Marcia Brewer

I applied this am for an Amazon visa to get a 70.00 gift card...I IMMEDIATELY realized I would not receive rapid on line approval which occurred...Then indicated further review of application would be required...I absolutely do not want a further evaluation and certainly do not need another credit card! I then called a chase representative and supervisor and told this process could not be deleted..really?? And why not...Chase has all my pertinent info and when "further evaluated" by an analyst why can't it be deleted by request of customer at that time?? I do not want a negative mark on my credit report and cannot fathom why this is not doable..I am a retired veteran with a fixed income and of course I will be denied..I made a mistake and am asking for assistance in rectifying this problem. Certainly SOMEONE can intervene and eliminate a negative remark in my credit report!! Would appreciate assistance, Marcia Brewer

On 9/1/2017, my employee went to make a deposit at JPMorgan Chase Bank, N.A. Patterson Acme Branch 000223; New York as usual.

Transaction # 168 & 170.

Rocio said to my employee ( you have a lot of money in your account, do you want your balance ?)

My employee answered, no, no, no----

Chase bank has put my life in danger.

This system of asking customers if they want to know their balance must stop immediately. I have been with this bank for years both personal and business accounts.

I been trying to get a release of lien on my title everyone giving a different answer I wish they get there stuff together there I have a checking and saving account with you i would think it should be no problem getting the lien off since its been pay in nov2003 if i do not hear back on Tuesday i am getting my attorney involved because i need this release of lien of to get my home equity loan to pay for my dad funeral home bill i have the funeral home on my case if my credit get wreck i will sue chase for taking to long to release the second mortgage lien of my property since 2033 that's holding up my loan

My wife has a checking acct with chase. I dont. I needed to go to the doctor because i am really sick and in pain. My wife wrote me a check on her acct there. I needed the full amount of the check for the doctor. They ( chase) wanted to charge me 8.00 to cash a checks drawn on their bank. Needless to say i couldnt cash the check or go to the doctor. How greedy can people be. Its sad a firm this big tries everything they can to steal a dollar. Sad. Probably after today my wifes acct will be closed. Dont lie say we care about our banking family. I was upset and in pain and so was my wife. What a shock.i am glad and i will never open an acct there. I know you will probably laugh and disregard but thats ok. Everyone will meet God one day.

Having been a Chase customer for decades, I think it's time to give my business to another bank. Today's experience with an angry teller was the worst yet at the branch located at North Lynnwood (Washington), branch #740318. "Andrea" was not just nasty, she was abusive. For the record, I am female, 68, speak fluent and proper English, and have had, at times, hundreds of thousands of dollars in misc. Chase accounts, as well as having Chase credit & debit cards, and a Chase mortgage for one of my rental properties. "Andrea" talked to me as though I were a dog, yelled at me, and was extremely nasty throughout the entire transaction. There was no long line, I was the only customer when I walked up to her teller position, so there was no particular reason why she should have been so stressed. When I tried to ask a question, she interrupted me in mid-sentence, saying that she had to concentrate on the computer screen. I was quiet and waited for her to finish. Then I asked another question, but she ignored me. This transaction was rather simple, consisting of a rental-check deposit, then a transfer of $4,000 from a savings account to my business account. There were enough funds to do the transaction. "Andrea" tossed me a blank slip to sign, so I filled in the date etc. before signing. This caused her to become very agitated, ordering me to "not do that, just sign!" I couldn't read her sloppy handwriting, so I verified one of the illegible account numbers. This caused her to become angry to a degree not justified. I told her I don't sign blank documents and that I had to make sure all was correct. NOTE: I am a real-estate agent and sign many documents, and I am well aware of how important it is to double-check all entries. "Andrea" shouldn't be a teller, she doesn't have the training to be a professional teller. I feel very insecure knowing that Chase employees that angry have access to my accounts, which at times have 5 or 6-digit balances.

back in June I was charged 297.20 for a flight on delta airlines that was not my purchase. I was asked to contact Delta Airlines and I did, but when I reached back out to Chase they said that there was nothing they could do for me. I was charged and Delta Airlines has no record of the purchase Chase claims dept refuses to even follow up with Delta Airlines on their own. How could $297.20 be removed from my account and no one knows where it is? I have trusted Chases Bank for years with my finances and this is completely unacceptable. PLEASE HELP ME!!!!!! I can be reached at 404-550-7235

Hello,

I opened an checking account with Chase and set up direct deposit, I was supposed to get a bonus of 200$ from the bank after I opened the account. Few days later I found that Chase came up with giving a bonus of 300$ opening a checking account with direct deposit in November. By the time I did not receive any direct deposit and my paycheck was yet to come. So i contacted the Chase customer service and asked them to give me the bonus of 300$ as I was still to get the first Direct Deposit paycheck.

They said they would provide me with the 300$ as soon as I get a direct deposit on my account. But I got 200$ direct deposit on my account. I called up Chase customer service again and surprisingly they disagreed with whatever they had said prior. They said they cannot give 300 $ and gave different excuses. I do not understand what kind of behavior is this, I called up to get the bonus of 300$ as my direct deposit came after the bonus amount was upgraded and the condition for bonus was getting the first direct deposit on the account. So I deserved 300$ instead of 200$. The bank should not be unfair to customers.

If the bonus is 300$ upgraded everyone should get it after the first direct deposit is deposited. I do not understand if the customer service agrees to upgrade it to 300$, next moment how can they change their word.They said I should get 300$ as the scheme was upgraded that month. If there was lack of information in the customer care executive then its a harassment to the customer and a sheer act of misguiding.

Chase should not neglect the benefit and the interest of the customers and confused them. They should help and give more benefits. I am extremely upset with Chase. I thought its a reputed bank who makes life easy for customer. If action is not taken and I am not given a compensation I would surely not be associated with Chase anyone and advice my family and friends to close their accounts on Chase. This behavior is unethical and upsetting.

I would rate them in the negatives. I went into Chase Bank off Highland Dr & 6200 S. There was only one person ahead of me but I had to wait 30 mins to be helped. Dave finally came to help me cash a check from one of his customers to myself. He said that he would need to do more research on the account before he could cash the check and because I wasn't a chase customer I would need to wait for him to help the 10 people in line after me before he would help me. I told him that it's wasn't fair I had been waiting for help and it was my turn to be helped and he shouldn't put me at the back of the line because I didn't bank there. The customer that wrote me the check was with chase and it's his job to help that customer by cashing the check.

He refused to help me and told me when he didn't have anyone waiting he would help me. The other customer waiting let me know he thought this was unfair as well. I asked how long I would have to wait and he told me he didn't know. I waited for another hour and half before Jill came in to work. She was nice and informed me she would just need to get ahold of the customer before she cashed the check she call him and he didn't answer but with this information I gave him a call and got ahold of him to let him know the bank would be calling and to answer so they would cash the check for me.

After I spoke to the chase customer they call again and got through and I finally 3 hrs later got the check cashed Oh but with an $8.00 fee that seemed a bit high. I would think customer service would be a lot better than what I experienced and this is not a way to get new customers. I may not have been a chase customer but after my experience I will never be a customer either.

I called chase bank customer service regarding a double charge on 12/4/2016. The customer service representative who said his name was JJ preceded to speak to me as if I was retarded. I could not hear him, he repeated himself in very slow motion as if I was an idiot. This kind of behavior from an employee is not acceptable. I have been a customer of chase for years, I am now officially disgusted.

Every time I go to the Chase branch located at 2301 E Colonial Dr in Orlando I experience problems with the teller Maria Vargas. I don't know how someone can have so little customer skills, treat people so poorly and yet get again with it. I am appalled every time I am in line to see how she treats other customers and myself. I understand this branch is short staffed after speaking to the manager but did we ran out of human beings that Chase needs people like Maria Vargas to reflect very poorly on their bank?

I've been banking with Chase for over 14years, worked for them for 12 years, I called customer services a few times and they did not try to resolve my problems. I have six different overdraft fees of 34 a piece thats over 214. Am on disability and my deposit go's into my account every month. Am on a fix income. Other banks don't treat their customers so poorly.

On November 1, 2016 I attempted to withdraw money from the Chase ATM machine located in Bexley Ohio and was unsuccessful. The ATM machine printed out a receipt that my transaction could not be processed at that time. The ATM machine went through the usual process of releasing money but none came out and the lights went out on the machine. Confused, I went inside the bank to report the incident and find out what I needed to do to get my money that was not provided.

The teller I spoke with filed the claim and informed me that my money would be refunded within 12 hours (at least a day). After two days, I was informed it would take up to the 15th of the month to refund my money. And during my inquiry today, I was told an investigation would be performed before they could attempt to give me a temporary credit. I am unhappy and unsatisfied with the process of refunding my money and am contemplating on transferring my business to another financial institution if this cannot be remedied expeditiously.

At branch location Vermont and Wilshire Blvd (Branch 3183 Wilshire Blvd) in Los Angeles, CA ...there are 10 customers waiting for customer service reps...only 1 is available. When I asked the manager where the other service reps are to help customers with a lobby full, he stated they are "busy in back". This is totally unacceptable. I thought customer service takes priority over and above anything else. I am upset that Mgr doesn't care about his customers and that they are not adequately staffed to handle us.There are 8 cubicle stations for customer service and only 1 rep available to assist customers! Someone needs to step on and correct this.

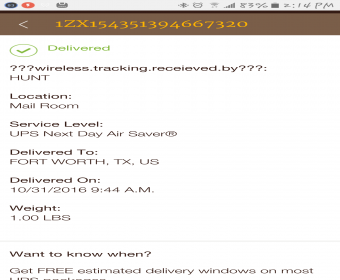

I traded my car in and the dealer mailed the payoff check but it hasn't posted to my account. The check was delivered on 10/31/2016. I now have a late payment on my credit report! I haven't missed a payment in 8 years and now because of Chase I have a late payment. I just don't see why the bank would hold onto a check and not apply it to my account.

I'm seating for an extended time in the Wolf Ranch Georgetown TX to move money from a saving account to checking all with Chase. I wish to close the savings account but am told do so I must meet with a banker. After 45 minutes I question the value of a banker being told the same thing I told a teller. Man up the branch or find a better process I don't appreciate you taking my time.

I have gone to the branch closest to me 3 times to get change and only once did they have any. This morning I try and I'm asked to wait 20 minutes for someone to open the vault. I was there when the branch opened. I don't have time to wait around when I have work at 9:30. Trying to find a way to let someone know with an email. I don't have time to be waiting on hold and listen to the BS customer service typical responses. Get it together, put an email option on mobile or the app stop wasting our time. Just cause you are on the clock doesn't mean customers don't have better things to do.

On 11/01/2016, my 86 year old mother who has a lot of medical problems asked me to go to the chase bank branch nearest to her home to deposit a one hundred dollar bill into her checking account to cover the bills she wrote. The teller there told me they don't accept cash deposits unless you are the customer. She then asked if I had an account at chase. I responded yes. She still would not go though with the transaction. I asked to speak to the branch manager.

The teller then hollowed down to another teller who said she was the manager and being funny told me to go get a money order and come back. As a customer of chase bank I'm upset with this kind of treatment an policy. If I became disabled I would probably need some one to make deposits or do banking for me. I'm very dissatisfied with your policy. It appears it doesn't hold any merit. If you continue to have this policy there should be limits on how much one could deposit without the customer's presents with the proper ID and other forms of identification. If this policy continue I will be forced to stop doing business with Chase Bank and request my associates to do the same.

My tax preparer deposit my tax return in the wrong account. This happened in February, i've been going through hell and hot water trying to get my money. i've done everything chase asked of me and still nothing. i've been kicked out off my place, lost my job and my family. I'm in the process of being homeless. Now a chase bank manger name James Roland has been very helpful. He and my tax preparer were working together to try to solve this issue, and still nothing. I talked to so many people from chase and they gave me the run around. Either they could not help me or just didn't care enough to help me. Now from february to now October, 30 I've been trying to avoid legal action. Now if chase doesn't fix this issue I'm forced to take legal action. My federal income tax was 5,549 and the state was 1,846.

An ACH transfer was made in error by my daughter and after several attempts, Chase will not reverse or send money back. This money is extra money that my daughter took from Sallie Mae and I'm paying for it each month. The amount of $2811.00 which is desperately needed is sitting in someone else's account that is active. I work very hard for my money and there are months I can't seem to get ahead. This is not right and Chase will not even call the customer to let them know about the error. How can someone keep your money if it doesn't belong to them.

Mobile banking has tried very hard to get this money back so it can go to me but Chase will not acknowledge it. Chase has stated they cannot take money from another account since ACH transfer was made to an existing account number. Ok how about the name? The check was made out to my daughter Deanna Rodrigues no where close to the name of where the ACH transfer went into to but yet they didn't reject it. Please advise what can be done. I am so upset over this that I will be closing out all of my accounts at Chase if this is not resolved soon. Please help.

Chase in fountain valley ca on new hope street. There is this short Asian guy that works there. Every time I go in he is extremely rude. I have canceled my chase account because of him. I had chase for so many years. I have never been treated so poorly. Every time I go in he is really rude and unfriendly. I don't understand how such a great company could keep an employee working for them that treats their customers so poorly. I just got home from canceling my account and am very upset for being treated so poorly by him. If I was manager in that bank i would of gotten rid of him years ago. He is pushing customers away. My mom and wife also closed there accounts because of him. My mom has been treated poorly by him too and so has my wife. After having them tell me how he treated them we all decided to close our accounts.

To whom it may concern. I called as I was making a payment to Dryer medical clinic and was double charged on my account as this was a over the phone payment. The customer service representatives was very rude and not a true caring person. Both the original rep that answer the phone and the debit fraud manager. I am sorry but people need to understand and have a heart when it comes to peoples money it is not my fault the Dryer debited my account twice for the same dollar amount they could see the error.

Every rep that i spoke to this morning was very rude and fake condescending voice over the phone. I have been a customer for sometime now and honestly not sure if i want to bank with you anymore due to the nasty reps you have working for you. I work in customer service not once did they apologize for the mistake or act like they cared to assist me sorry for asking for help from your company. I do not need to be spoken down to when I am trying to make my account right and asking for assistance.

Chase bank fraud line embarrassed me. I was in public making purchases at an expo for a final Chicago marathon! My last! And I was with friends and family and had to give back my purchases not once but twice "for my own protection"! I'm sure chase didn't decline everything person from around the world visiting Chicago this week, and I live here. I can't even go back to get the items I was buying for out of town lived ones! This is despicable, and you do it in the name of security and wait over two hours to notify me if I've "approved" these declined transactions? Why would I approve declining my purchases when you have taken it upon yourself to do so.

Chase Bank refuses to stop flooding our business mail box with unwanted, non-recyclable paper junk mail. This is despite several written request to stop for the past 2 years, and even filing a complaint with the BBB in New York City. The mail is addressed generically to "Our Neighbor". Chase Bank claims on their web site how "green" and environmentally friendly they are. What a joke! Just another hypocritical big bank that floods the country with unwanted junk mail while their management makes off with millions. "Green" - Yeah Right.

I went into the Burien, WA. branch, as I do every month, to make my pmt. on my Chase/Amazon card. 9/2/2016. A teller named Vicki took my $ and my bill. I received my receipt and realized she had not given me my change due, $15. I had given her 2-$20's. My bill was $25. She shuffled a few bills in her drawer and then told me I had no change coming because I had given her 2-$10's. I said she was wrong, I knew what I had given her. How could I have paid a $25 bill with 2-$10's? Her boss then came over, they were quite busy, but they went through counting and "balancing" her til. They then claimed it balanced. At this point I knew I was not going to get anywhere with them, so I went on my way.

When I got home, I looked at the receipt Vicki had given me, and it said I paid $25. Now any idiot can figure it out, if I gave her the 2-$20's as she claimed, she should have come up $5 short. The 2-$20's I gave her would have had her $15 over. Do you understand? I cashiered for many years and before that I did payroll for a construction co., so I am very learned on dealing with $. How could she have balanced? That would not have happened if she did her til correctly. I am a senior, disabled, living on a very low income. I need my $15 back and they are now saying (from their "executive office" that I had also given Vicki a $5 bill. They switched their story up. Now, here's what really happened.

After she said I gave her what she says, I did become flustered, and I started to hand her a $5. Then, right away, because I knew she was pulling a fast one on me, I told her to give the $5 back, which she did. So, here it is a month later and this is how Chase treats the underdog, over $15! I am so disgusted with these people, the letter I received with the new spin about the $5 came from Houston,TX. The lady who wrote it was NOT in the bank I was in making my payment. They seem to have their own little "brotherhood", same as the police.

Cover for each other, I don't know what else to think. So, there you have it, I, at this point, would let this go, but there is right and there is wrong. I am real tired of these huge banks, etc. raking the public over the coals, and I want this figured out and I don't gamble, but I'd gamble they made a mistake and for some reason they can't bring themselves to right a wrong.

I am a Chase customer for over 10 years and have a mortgage with them. Recently I needed to get a " witness to identity" and just have the back of 2 pictures of myself signed/ notarized by a bank or notary. The Chase bank on 27th Street and Park Avenue in New York City refused. I went to the M & T bank where I am not a customer and they did the documentation without any issue. I have had other problems with Chase about 6 months ago where I needed them to notarize a "request" to the US Dept of State for a certified copy of my passport and they also refused.

I was not asking them to notarize my passport, only to notarize my request to get a certified copy of my passport. The bank manager called to apologize and that they were mistaken and could of done the authorization. Again, I also went to the M&T bank and they did it immediately. What is really strange is that another Chase branch on 27th/5th avenue in New York City voluntarily notarized photos of me without any problem. So my complaint goes directly to the branch on 27th street and Park Avenue. The person who received me was Michael Slattery and he was so rude.

To whom it may concern. I would like for this letter to reach the Chase Bank CEO. I am sure that it won't even reach a person with concern of my complaint. I bank with Chase for sometime now . My complaint has always been the overdraft fee. I get paid every Thursday and on Wednesday at 11:00pm if I don't have enough in my account to cover something you guys put a overdraft of 34.00. Which I don't understand when you have knowledge of my direct deposit on Thursday morning. If Chase bank was anything like other banks and put people checks in at midnight or give the next day to deposit money I or no one else would be paying so much in overdraft. I have kids and so do other and this among of money hurts us.

It makes me sad to see that other banks works will people and your bank to me is out to take as much of our money as you can. I worked Labor Day and someone gave me a check that was not good. I have vendors to pay and I can't catch up to even get my account right to pay them because of all the fee. Which is stressing me. That is not your problem but all the overdraft fee is a problem. Other banks don't do this they give you to the next day to make a deposit. Which if you did my account would not face this same problem every week. Everyone is telling me to leave your bank and go somewhere else because you are a bank that don't care. I called today and got 19.00 from 274.09. I have my money to put in my account due to a mess on my deposit due to boss error but I need help here.

What is my complaint against those employees that is doing racial profiling me every time I come into this bank. The two Chase employees that continue to be racist against me at this particular branch. I came in today, Sept 21, 2016 and I needed some paperwork to be notarized so this was my first time with Cheryl. We both was pleasant then Cheryl said am I aware of my account being in the negative. And I said yes I am fully aware of it, but however I did not come into this bank to discuss my account. I stated that when I get more money than I will put it in my account. Then she was so rude because of the color of my skin which I will not do a damn thing about it. I am going to continue to come into this bank professional and carry myself accordingly.

I also told Derek about a couple of months ago that Ben is rude toward me especially when it comes to my account and me wanting my documents notarized for the unclaimed funds that I have found in my name. If I have to come into this bank one more time and see Cheryl and Ben about anything they better treat me with the utter most respect and stop this damn hatred and nick pickin with my documents and so on. Please don't let me have to take them to court on a legal issue of harassing me about my account, 401K or anything else. I know that the state of Indiana has always been a racist place to live but it would be unfair for me to say if everybody was hatred. Not everyone is hateful and mean and rude.

I want to be treated just like everyone else that lives in the Nora/Castleton Area or any place else that does business with Chase. I am going to complaint continue both of them lose their damn job. It is always something at this bank. Everybody else is nice and pleasant especially the bank tellers and others like Derek which he apology to me for McHenry's action. This man just want to close out my account without giving me a chance to work through my issues of having a IRA account or anything else. All because I need my money from my IRA account to pay my rent. Then Ben try to say that I was stealing ink pens from his funky desk which I don't need to steal anything from people. People take candy, pens, and so on and they don't make a federal case out of it.

Those two employees need some time off from this bank because I will not tolerate how they mistreat me and it is not any courtesy to tell your customers that they account is in the negative. Let Ms. Hall and Mr. McHenry know that they are not dealing with someone who does not know policies, procedures, rules and regulations and so on. This has got to stop. They both just need to stick to helping us customers out without persecuting me about everything. These two individual don't have it like that and they think that everyone is struggling and doing bad and so. They can lose their job just like everyone else in the world.

I received a new Chase Freedom credit card and when I call them to activate it, they say that my account is under review by special team . When I ask to contact me with that team who is reviewing my account they refuse to do it and keep asking me to give them a contact number so they can call me back. For what? To give me the same security questions to have a proof that is me? Sadly I don't have a cell phone service in Wyoming state and I can use only payphone. I typed them online that customer service can not help me and they can not help me ever. Now I have a peace of plastic in my wallet just for decoration.

I use quick pay and it's been 15 hours and the money I put for my wife in Waco TX visiting her son at Baylor is still waiting for the money I sent her for the hotel has not arrived in its 11pm central time. This is wrong, the money was suppose to be there in minutes, that's what it's for. As soon as I can I'm going to change banks.

I recently misplaced my debitcard, I thought I was doing the right thing by contacting the bank to replace it. I went to two different locations to try to receive a replacement card. I was told I could only get it mailed to me because of a new rule they implemented it without prior customer notification. They told me I had to use the same ID I used when I opened the account, if I had known when I updated my identification information I needed to update it with Chase I would have. They didn't do anything to try to assist me in this situation, all they could tell me is this is a new rule. I have electronic bills coming through off of my closed card, a direct deposit, with a holiday approaching, and I work during regular banking hours.

We live in Brazil. We received a letter about our safe deposit box. I tried calling Chase Bank in Arlington, Texas, and I only received an automated answering machine telling me to call a 1-800 number. I called the number and finally got a live person. Well, live as in off shore. She could barely understand English. I knew this, because I told her that I was calling from Brazil.

She informed me that I needed to go to the branch closest to me. I said, " that would be about 7,000 miles away. She didn't know how to help me. I asked for a supervisor - same crap! I asked for another supervisor. Finally I'm connected to someone in the states. He says he's not able to help with safety deposit boxes. What's going on with Chase? I've been banking there for over 30 years! If I have to, I'll leave Chase and persuade our mission to do the same. Our mission has a lot invested in Chase.

Every time I make a purchase that may put me over the overdraft threshold by a small amount (eg. Not enough to impose a fine, I am finding that my transactions are being processed in a much different order. Larger purchases are made before this smaller one and is being rearranged to overdraft my account over the threshold. This has the appearance of being purposely done to impose multiple larger fines and I'm growing increasingly pissed off about it. Say I buy an item that costs $56 with $52in my account (52-56= -4, still not over the fee threshold) then I buy an item that costs $4 (again still not over the threshold).

However, the $4 purchase processed the day it was made and then the $56 one is left pending when it was made at the SAME store ONE DAY EARLIER. This results in the math looking like this: $52 (beginning balance) -$4= $48. $48 - $56 = -$8.00. This then puts me over the threshold and charges my account the fee. It's bull and is being manipulated to do this. I will NOT continue banking with Chase for these dirty profiting tricks.