Wells Fargo Complaints Continued... (Page 2)

320+ reviews added so far. Upset? Call Wells Fargo corporate: 866-878-5865

Have a Wells Fargo account have been in the hospital for the last 5 weeks made arrangement with my mortgage services to change my payment to the 14th. They still put it thru when they felt like it so Wells paid it an started a land slide of fees they just sent all the small drafts. Same thing this month not something you want to deal with after coming home from hospital.. about 800 in fees so far

Hi,

I bank at your Gammon Road branch in Madison, WI (Branch number 1403)

I went there today and wanted to use one of the outside ATM machines. It was raining and the roof above the AMTs

only comes out about 2 feet!! So to use an ATM I would have to stand in the rain. If you really care about your customers

you should extend that roof to at least 4 feet or maybe install an awning to keep your customers dry.

Bob

P.S. Since I was there during business hours, I went inside to do my transaction.

I have many accounts with wells fargo (personal and business).

Misrepresentation by a Wells Fargo reoresentative regarding a merchant machine that I have been paying on since 2016 has caused me much anxiety. The machine stopped working in 2017 and we reported the malfunction on several occasions to wells fargo. We were at these times advised that we would need to contact another vendor. We were never advised that a vendor was involved initially when the contract was signed.

I have been paying $57.70 for 1.5 years with no functional machine. It is unacceptable for Wells Fargo to offer this machine and service only to refer me to a vendor when issues are presented.

I have sent a formal complaint to the branch that offered the contract and the response is ... "You must contact the vendor." I am making thus last attempt prior to seeking legal assistance. It is totally unacceptable for anyone to expect continued payment on a merchant machine that does not and has not worked for a year!

Again, this misrepresentation has caused me much anxiety over the year.

I have many accounts with wells fargo (personal and business).

Misrepresentation by a Wells Fargo reoresentative regarding a merchant machine that I have been paying on since 2016 has caused me much anxiety. The machine stopped working in 2017 and we reported the malfunction on several occasions to wells fargo. We were at these times advised that we would need to contact another vendor. We were never advised that a vendor was involved initially when the contract was signed.

I have been paying $57.70 for 1.5 years with no functional machine. It is unacceptable for Wells Fargo to offer this machine and service only to refer me to a vendor when issues are presented.

I have sent a formal complaint to the branch that offered the contract and the response is ... "You must contact the vendor." I am making thus last attempt prior to seeking legal assistance. It is totally unacceptable for anyone to expect continued payment on a merchant machine that does not and has not worked for a year!

Again, this misrepresentation has caused me much anxiety over the year.

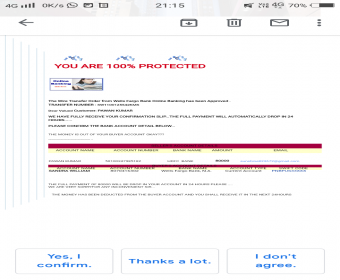

WELLS FARGO BANK USA

Yahoo

/

Spam

Timothy J. Sloan <silvia.campiglio@alice.it>

May 10 at 9:14

FILE: WELLS FARGO BANK USA

TELEGRAPHIC TRANSFER NOTICE OF US$10.7 MILLION TRANSFER

Dear Customer;

The Wells Fargo Bank controlling department controlling of the security transfer CODE which is (wfu/200/105/09), the Authentication section code of this bank concludes the verification of your file. After going through all the documents of claim received by this department with justification and verification from the global strategy America, we are completely satisfied and you have been confirmed.

The Wells Fargo Bank concerning wire transfers of your funds. Your letter has been referred to the (FSA) Legal Division for Funds (US$10.7 Million Dollars) Transferred code. (WFU/200/105/09). We are satisfied using Electronic Wire Transfer or Swift Wire Transfer and the rights and liabilities of using of electronic and Swift fund transfer systems are defined by the Electronic Fund Transfer Act.. The regulation, however, which implements this statute, 12 C.F.R. Part 205, Regulation E. specifically states that its provisions are inapplicable to a situation such we must ensure your Funds Transferred to your destination Bank Account between 10 hours.

Considering the volume of your payment, it is right for us to seek for the approval of some money regulatory Boards here in United States before we can carry out the Transfer of an amount of such magnitude to anybody, otherwise any such transfer will be stopped by the Financial Service Authorities and the International Monetary Fund, since your Transfer is Electronic Transfer is almost activated with our bank and the only thing holding the final activation of your Account are Electronic wire transfer and Approval Document charges from the concerned Authorities here in United States, and for that reason, you are required to pay the Sum of $162 only (The TOTAL FEE) for the transfer and to obtain the necessary documents that will enable the final activation of your Funds.

In respect you are required to send the Electronic Transfer and Approval Documents fee $162 only [BANK B], under section 47-4A302 of Wells Fargo Bank United States of america's law, a depository institution which wire transfers funds may not deduct any fees for handling the wire transfer from the amount of money which is to be transferred to your provided Bank Account.

The fastest Wire Transfer is Electronic Transfer which only takes just 3 hours to reflect in Account, and Swift Wire transfer takes 5 hours to remit.

You are require to get back to me if you are pleased with the Banking rules to issue you information where you can the required charges for your Funds ($10.7 Million) Wire Transfer processing to commence as soon as possible.

This law is stated according to section-35 And-36 of the banking sector interaction realm of our constitution and the outside world. Based on article of association and memorandum of association, the Chase controlling agency of USA and your happiness suits our stand and we will make sure that your fund is fully endorsed to your bank account as soon as you have comprehended with our instructions.

NB: THIS TRANSACTION IS BEING MONITORED BY THE UNITED STATES OF AMERICA GOVERNMENT IN ORDER TO GUARDS US FOR INTERNET IMPOSTORS.

(Designated bank account details for Electronic Transfer to avoid mistake or should in case you created a new account)

Bank Name and Address

Account Number:

Account Name:

Routing Number:

Occupation:

Mobile Phone:

If at any time you have questions, concerns or comments, please contact us as we strive to ensure that you will always receive a prompt and courteous attention.

Thank you for giving us the opportunity to serve your banking needs.

Yours sincerely,

Timothy J. Sloan

Chairman, Chief Executive Officer,

Chief Executive Officer of Wells Fargo Bank

And Director of Wells Fargo Bank

Reply, Reply All or Forward

Send

Settings

Timothy J. Sloan

I have been a customer of Wells Fargo for over twenty years , and Wachovia before the buyout. It is inconceivable that the employees of Wells Fargo have so little interest in the customers . As of this morning I tried to resolve what to me is a very important issue/problem only to be met with the most bizarre excuses I have ever experienced in my entire career as a business owner and customer of the bank. I established an equity line for some renovation on my house about 2006, right before the residential meltdown as a result of banks and mortgage companies , without any regard to basic good business practices, loaned money to anyone as long as they had a pulse and without regard as to their ability to repay those loans. That is the crux of the failure of the residential market and the subsequent recession. Wachovia/Wells immediately and without reason withdrew my equity line with the excuse that it was in fact too risky, clearly a typical example of closing the door after the horses have gotten out.

I have been paying off this equity loan without fail , on time and as agreed. Recently, Wells Fargo has changed some internal processes which apparently is affecting the small amount of money involved with this loan. I received a notice that this equity line was now a mortgage . As of this morning I am still at a loss as to what when and where this happened. None the less , this morning I tried to investigate the entire issue of the "loan" or what ever verbiage was used. I have a statement indicating that 2/28,3/15/and 3/30/ funds were received by wells and noted as unapplied , also noted on this same statement was a notice that a current payment of 189.40 was due and if I lived long enough to get to Oct 9th of 2018 the total amount due would be 1036.02, also noted was the fact that I have 737.80 dollars of unapplied fund balance. What was explained to me was that this was in fact as it should be and of course this was accurate until I became argumentative so I explained my concerns to Antonio @ ppx 10.10 am who hung up the phone on me at 10.20 while on hold, consequently I called back and received Jackie on the phone @ 10.28 who put me on hold until 10;30;then explained that I would be forwarded to someone who could explain this whole thing accurately so that I could understand it. about 10.35am I was once again forwarded to a senior manager in the executive offices named Vanessa Jones, who was listening to my explanation once again and the phone disconnected for the final time @ 10.45 am.

Four people over 25 minutes with two hang up is enough for me. What I do know is that if there is this much confusion, I truly understand why Wells Fargo has been accused of and found to be in violation of many of the laws in the land. Apparently this is another example of deception on the part of Wells Fargo where that are dealing with customers.

April 13, 2018

To Whom This letter may concern:

I am very disputed with Wells Fargo I spoke with customer service agent and was advise that my late fee would be remove off of my account due to the fact your automotive system was not working properly and I took a look at my credit report and I have outstanding credit and you guys did not live up to your word. I know that there have been a lot of bad news about your Bank in the news for the last few years but, as a consumer I still tried to give you guys a chance if this is not remove from my account I will be contacting the 3 Credit Bureaus and find me a bank that cares about their customer and that will not tell them the untruth. This is in regard to my Home Furnishing account ending in 9997.

I can be reached at 904-778-1862 if there are any questions.I do look forward to hearing back from someone soon regarding this Business matter. Customer Loyalty is very important.

Regards,

Donald Lyons

My company Hometec, Inc. as well as myself are customers of the bank. With that being said, my company was approved for an SBA loan 3 1/2 years ago which the bank has now decided to term out. My bank contact assigned to me for this matter is Mary Jane Conley and she is located in your Roseville office. From the very beginning of my experience with Ms. Conley, our interactions have been quite strained to say the least. On February the 8th, I received an antagonistic call from Ms. Conley wanting to know if I had paid down a portion of the principal amount of my SBA loan from personal proceeds that I recently received from the sale of personal property unrelated to my company that I was on title to. I explained that I had no intention of using those proceeds to pay down the loan nor was there any understanding that those proceeds would be used to pay down the loan. Ms. Conley then accused me of not owning up to my commitment to use those proceeds to pay off a portion of the SBA loan. The conversation then turned in to a heated debate as to who said what at which point I insisted that I be on record for stating that the property sale and subsequent proceeds received were not tied to this loan whatsoever. Ms. Conley acknowledged that request and then proceeded to hang up the phone on me.

As you might agree from my statement made in the above, Ms. Conley's behavior toward me or any customer for that matter is totally unacceptable and way out of order. I have not been late for one payment on this SBA loan so why should I be subject to such harassment? This is not a default situation but one might think that Ms. Conley might want to see it or treat it as one. I have always been a customer in good standing with Wells Fargo and as such do not appreciate being treated like a high risk loser. The loan term out agreement that I was forced to accept was not drawn up in mine or the banks best interest so I would like my account to be reassigned to another associate in your Credit Management Group. My goal as always has been to pay down any debt that I acquire but to do so, the arrangements of the payoff need to be fair and equitable in order to be achievable. All that I am asking for are reasonable terms so that my company can comply with the terms and conditions of the payoff without a stranglehold around its neck. Such a request is really not that much to ask for and something that Ms. Conley should be trained to do if she cares to work in the best interests of both sides. Instead, intimidation is what Ms. Conley seems to thrive upon and do best which more often than not leads to a failed resolution.

Sincerely yours,

Eric Kamino

President

Hometec, Inc.

Tel: 760-346-8824

Fax: 760-340-6652

Email: Rickkiam1@gmail.com

My company Hometec, Inc. as well as myself are customers of the bank. With that being said, my company was approved for an SBA loan 3 1/2 years ago which the bank has now decided to term out. My bank contact assigned to me for this matter is Mary Jane Conley and she is located in your Roseville office. From the very beginning of my experience with Ms. Conley, our interactions have been quite strained to say the least. On February the 8th, I received an antagonistic call from Ms. Conley wanting to know if I had paid down a portion of the principal amount of my SBA loan from personal proceeds that I recently received from the sale of personal property unrelated to my company that I was on title to. I explained that I had no intention of using those proceeds to pay down the loan nor was there any understanding that those proceeds would be used to pay down the loan. Ms. Conley then accused me of not owning up to my commitment to use those proceeds to pay off a portion of the SBA loan. The conversation then turned in to a heated debate as to who said what at which point I insisted that I be on record for stating that the property sale and subsequent proceeds received were not tied to this loan whatsoever. Ms. Conley acknowledged that request and then proceeded to hang up the phone on me.

As you might agree from my statement made in the above, Ms. Conley's behavior toward me or any customer for that matter is totally unacceptable and way out of order. I have not been late for one payment on this SBA loan so why should I be subject to such harassment? This is not a default situation but one might think that Ms. Conley might want to see it or treat it as one. I have always been a customer in good standing with Wells Fargo and as such do not appreciate being treated like a high risk loser. The loan term out agreement that I was forced to accept was not drawn up in mine or the banks best interest so I would like my account to be reassigned to another associate in your Credit Management Group. My goal as always has been to pay down any debt that I acquire but to do so, the arrangements of the payoff need to be fair and equitable in order to be achievable. All that I am asking for are reasonable terms so that my company can comply with the terms and conditions of the payoff without a stranglehold around its neck. Such a request is really not that much to ask for and something that Ms. Conley should be trained to do if she cares to work in the best interests of both sides. Instead, intimidation is what Ms. Conley seems to thrive upon and do best which more often than not leads to a failed resolution.

Sincerely yours,

Eric Kamino

President

Hometec, Inc.

Tel: 760-346-8824

Fax: 760-340-6652

Email: Rickkiam1@gmail.com

I went into my local branch yesterday, the 10th of January. A woman named Marrissa helped me. I was withdrawing $7500.00 from my checking account. Marrissa was really looking through the computer and started asking me a-lot of strange questions. As she was looking through my account she said you know the checks that you deposited on the 8th, that she thought one might come back, and I replied, they were on a hold and did clear your bank already and besides I already had over $12,000.00 in my accounts prior to those deposits. Then, she asked me where the checks came from, if they were all from one place or more than one, how long it took to get them, and something about the taxes on them? Then she left and came back with another teller and the 2nd teller said, "Hi how are you today? By that time i was feeling very uncomfortable. She then asked me what I was going to do with the withdraw money, and what my plans were? I thought that all of these personal questions that have nothing to do with her, or the banks business was very strange! I felt as though I was being interrogated. I don't know if this is your procedures at your bank, because I have never had this happen to me anywhere else in my whole life! Then, after 45 minutes of questioning, waiting in line, meeting other tellers, I finally got MY MONEY, and when I turned around to walk away, Marrissa said, maybe your going to buy a mobile home. I thought about it on the way home and I remembered that the last time I came inside the bank about a year ago and made a large withdraw she was the same clerk who helped me then. I had told her then, that I was thinking of purchasing a mobile home with my money because she asked many questions then too? I am very unconfortable with this protocall, and frankly it is not your banks, the teller's, or anybody's business what I do with MY MONEY! I was prepared to open another account for my Grandson this week, instead I will be closing ALL of MY Accounts.

Ok so I had a motel run my card for an amount of 63.00 then the motel refunded my money due to me changing my mind. Now when I went online the reversal shows but I never received the money. On my online it shows the reversal first then it shows where the money was taken out. I have called several times about this issue and was told that the money had already been refunded. However, I was never able to spend the money. The money never came back to me I have done a reversal before and the funds were available. This is not the first time this has happened and I can not afford to be giving money away or losing it so I will be banking somewhere else.

I visited my local Wells Fargo Branch Office in Ingleside, Texas. The purpose of my visit was to discuss and resolve a very unsatisfactory experience I had with Wells Fargo Online Banking and how they handled notifications of suspected fraud regarding my accounts. The short conversation with the Branch Manager resulted in several things ...

1. She immediately defended Wells Fargo Online Banking procedures without every hearing me out. I left the office without every having the opportunity to explain either the full experience or my suggested workable solution.

2. She had no interest in speaking to anyone who would dare to question a Wells Fargo procedures or her authority within that branch office.

3. Her attitude was that I could close all of my accounts and take my business elsewhere.

Is this the Wells Fargo Corporate position toward any customer who finds themselves the victim of poorly executed internal Wells Fargo procedures? If not, what are my options?

Dear Wells Fargo.....I have been a customer since 2010 here at your Sun City Wells Fargo Bank Fl 33573 ..with 3 current accounts to wit: Crown Classic Banking #1010288052157,Wells Fargo High Yield # 9973517932 and standard brokerage just about more than 100K and uses your Debit card like my own cash...I love your service especially the courteous people around you when doing banking..except this late afternoon incident . I was trying to deposit a dividend check to my Crown Classic Account worth only ($141.41) from Wedbush (a stock investment co.) to my Crown Classic Account which I have been doing for almost a year now. Suddenly your cashier (Marilyn) noticed that aside to the two principal payees which is me and wife my heirs names which are my sons and daughters where also written on the front, I am not a banker and such format can not even understand..the cashier consulted with the manager (punk rock dyed red hair) and they both agreed that the bank can not accept such deposit If ever I have to bring my heirs who resides in LA to the bank and be recognized. or use ATM outside the door if I need cash. I was so demeaned and embarassed and felt helpless. Chase bank welcomed me openly and took my deposit expediciously. Thank you!..Carlos G. Patriarca (your long time customer).

Visit your location on 1000 Tyrone Blvd N, Saint Petersburg, while waiting in the Drive thru my wife and I notice that it was taking awhile, once our turn came there seem to be a problem with the $9.527.99 check we were trying to deposit. The whole experience was a "LiL" time consuming

moreover once the manager came up to the window she inform us we would need to come in ( Wife Running Late For Work) so we went to another Branch closer to her job (2350 34th St N, St Petersburg ) once there proper ID shown I notice the Manager observing "Closely" the teller wrote down note's concentrating on monitor gave a feeling of we were Thief's while the manager went into a room (we made mention she was calling the other manager to( let her know we were there Re;1000 Tyrone Blvd N, Saint Petersburg). She reappeared after 2or3 mins, teller then call her to let her know he was trying to deposit the CHECK. I I want you guys to know Your Branches gave a Scapegoating situation where we felt like THIEF's.

I've been paying the entire 800 dollars on my secured credit card for a year. Now once I realize I wasn't really getting anywhere with it I cancelled my secured account with 34 dollars credit on it. I was positive 34 dollars when I cancelled it. Now they telling me I owe them money but how can I owe them when I've paid my card full and had 34 dollars credit. They took my 800 dollars as collateral and now saying I owe them

My mother and I have been flooded out of our home. We live with my brother waiting on our home to be repaired. I had problems with insurance and it took awhile to get the settlement. I took the check to the Clear lake branch to deposit into my account I have had for 30 YEARS but because the check had my name and my mother's name on it and her name is not on my account the teller manager would not deposit it unless I had a power of attorney. I returned with the power of attorney form signed by my mother who cannot walk or sit up for more than thirty minutes and I had her ID and social security card spoke with accounts person who also said the power of attorney had to notorized and could not deposit the check. I know security is harder now and I had deposited an insurance check for the same purpose with both our name's on the check in my account with just my name 2 years ago with no problem. But what I am upset about is that they did not research me they did not look to see I am a 30 year customer and with your sign saying Wells Fargo cares apparently you don't care no one reached out to their superiors to see if they can with their authorization deposit the check and to see I am a criminal. Now I have to to get a notary that can come to my house and I have to wait 2 weeks, for notary 1week and another week for check to clear and needing to pay workers. I feel like I am not a customer you care for. I am looking for another bank to give my business to.

Unacceptable response and service in trying to change 2 brokerage accounts out of Wells Trade.

Dear Sirs Madam

I would like to communicate an extremely frustrating experience trying to change 2 of my wells fargo brokerage accounts currently with Wells Trade back to self directed with Wells Fargo. Unfortunately I have followed every bank instruction, used the bank forms the bank sent me, faxed them in twice, once myself and the second time through a wells fargo brank here in Pearland Texas expecting that would be accepted and correct.

Unfortunately still no action has been taken to change them and am now being told that I used the wrong forms. Nice try to deflect, they were the forms that Wells fargo emailed me to use. I can't accept that. Forms are attached

I am at the point of transferring these accounts to Fidelity if this is not done. I spoke with the Wells Fargo Wells Trade rep today and again I am being told I have to send in the forms again, which by the way are the correct forms.

THank you for any assistance with this. It is my last try to fix and then I have to transfer the accounts out of wells fargo since there seems to be no other choice.

How is it that after sitting in line at drive through for 25 minutes and present a check to get cashed your employ told me no then screams at me after she has been rude to me . That’s absolutely unacceptable.

This is two days in a row I have present a check to get cashed and for whatever reason had to go to another branch and not have a problem .

I am not happy and will not tolerate this type of poor buisness. After 29 years years with this bank I am closing my buisness and personal account as soon as possible .

No one will read nor care about this but I feel better to write it down because I am mad .

The fact it has taken Wells Fargo more than 2 years to get money from my dads estate is a testament to just how disgusting of a corporation you are. Well Fargo screwed up the paper work from the first day, which was 6 months before his death. Now 2 years later I had to get a court order for WF to release his money and they still will not release without doing more paper work which has been done several times! WF HAS NEVER GOTTEN THE PAPER WORK THE FRIST TIME. NEVER..... EVERY DAY I TELL EVERYONE I SEE ABOUT MY HORRIBLE TREATMENT by WF. Please have someone call me so I can express my pure HATE for WF. How in the HELL can anyone work for such as low life company.

On 10-27-2017 I applied for a personal installment loan. I received the loan of $24,000 and my first due date was November 15th. I made the first 6 payments in anticipation of my work being slow in the winter months and I wanted to make sure I had my payments on time. I have had mortgages, numerous cars, a boat and credit cards with Wells Fargo over the years and I have never been late or missed a payment. That said I was surprised when I was not 6 months ahead but only 5 when I looked online. One of my payments was reversed and applied to principal. I called Wells and they said it could only be paid up so far and she was not sure how far that parameter was. 2 days later, I looked and 3 more payments were reversed and the due date was now January 15th. I called and the gal said they would reverse the payments and put the money back in the checking account. I have had that checking account since 1993 by the way. So today I looked and it was changed again to due date December 15th and another payment reversed and applied to principal!!! I am now due 4 payments to be reversed off my principal payments to my checking account.

I feel Wells Fargo has manipulated my account so I would be late so they can collect late fees and they made changes without notifying me or asking me what I would want. I feel with all that has been going on with Wells Fargo in the news, that I am being taken advantage at the worst and given poor customer service at the best for not being contacted . I want my 4 principal payments reversed and put into my checking account immediately or I will contact my attorney.

Regards,

John C. Pfaffle

515-669-7283

3918 S. 226th ST

Elkhorn, NE 68022

The branch at 8812 Corbin ave. Northridge Ca 91324.

The atm machines are filthy.

On Monday September 25, 2017 I went into the Val Vista and Warner location of Wells Fargo in Gilbert AZ

I wanted to transfer 2000 into my IRA---EVIDENTALLY I WAS TOLD --was that the VOLUNTEER working with customers didn't know properly how to do it and as of now my 2000 deposit is MISSING?????

Really guys????

I do have my IRA receipt that I made a deposit but as of now the deposit is missing???? and not credited to my account

any help would be greatly appreciated

Thank you!

Billy Nitzschke

602-318-4466

My daughter applied for a student loan through Wells Fargo and was advised she needed a co-signor for obtain the loan, which was the difference in the amount of the costs at WSU and her financial aid award, about $8,000. We started the process on Aug. 22nd. I agreed to co-sign and used the online portal to submit the documents requested August 23rd. This is when the issues started: After my first submission I received an email from Stephen.Lautzenheiser@wellsfargo.com advising he was going to be the point of contact and help throughout the process. However, that is not what actually happened.

I was out of the country from Aug. 24-September 2. My only access to communication was through the online portal and web based communications. I had no international calling, so I emailed Mr. Lautzenheiser on Aug. 29th to find out why the application was still showing as pending and what if anything further was needed. He failed to reply to my email. Rather, I discovered a phone call from a 2nd lady was left on my cell phone while I was abroad upon my return to the states September 2nd. Then there was the long Labor Day weekend. I returned the call to the lady and she advised more documentation was required, including copies of my bank accounts showing my name on the statements. I again explained that I had many bank accounts but because my husband and I were in the process of purchasing a home I was only going to provide those statements with my name alone, and I did that. One of those statements included my money market which would have been more than enough to secure the small amount of the student loan my daughter was requesting. I had already provided my 2016 income tax return showing a significant income for 2016 as well as income information for 2014 and 2015. I was required to supply much MORE than my daughter attempting to get the loan and I was only to be a co-signor on the account. I followed up my conversation with an email to Mr. Lautzenheiser who apparently forwarded it on to another department instead of replying to me. I sent him two to three emails in which he never replied. He called me one time during the day while I was in a trial and only left a message requesting a return call, but not leaving any reply or content. I received 3 calls, each time from a different WOMAN asking for more information [rather than making one request for everything]. I found Mr. Lautzenheiser to be lacking in customer service and the entire process to be inefficient and in the end, Mr. Lautzenheiser had the audacity to reject me as a co-signor on my daughter's behalf. I would not have submitted this complaint but it is not the first time my family has been treated poorly by someone working for Wells Fargo claiming to be following policy. We used to have a mortgage with Wells Fargo and we did not like them then, which is why this time we went to BECU for our mortgage. This past experience with Wells Fargo has soured me for life and I will tell everyone I know to NEVER work with Wells Fargo.

I am executor for Willie Norwood of 1916 Cecil St, Durham, NC 27707. This property was inherited by Catherine Simmons at 12703 Prestwick Drive, Fort Washington, MD 20744. All probate papers have been filed with Wells Fargo. They refuse to speak with Catherine about refinancing the loan for this property, even though she is now the rightful owner. The account number is 0334583564. All of my calls are routed from person to person, and each one in a different state. It seems as if they want the property to go into foreclosure. Or they just want her to make payments without proper finalization or transferring of account. What next?

I went to the Wells Fargo branch to ask for a streamline refinance and was giving a very good rate and great closing price. This was back in July and now we are in November and they kept changing the closing fees to thousands of dollars. The wells fargo lady didn't seem to know what she was doing. So after 4 months of waiting on a 30 days streamline refinance i told her to cancel the paperwork. She said she would and that i would get a letter in a week saying i cancel the paperwork but instead I'm getting payoff information and Fedex envelopes from wells. I keep calling the rep but she won't answer the phone and turn her machine off so i won't leave her any messages.

I sold my house and property to a young man in September 2016 and I recommended Wells Fargo, one of the biggest mistakes I have ever made. Now here it is Nov. and. I am still waiting on it to close. It just went to the underwriters 2 weeks ago. I have lost 2 sales and found something I want to buy. I can't believe how incompetent Wells Fargo is and this is not acceptable. It is no wonder that the company is in trouble.

Terrible, Wells Fargo closed my account long ago for reasons unknown I was told to bank elsewhere. Went into your bank today with a check and was told it had to be verified, check was drawn on your bank all the proper ID was shown. I called the insurance company and was told it was not necessary to verify the check and they issued no such directive, it was solely at the bank branch's decision! I went into another Wells Fargo and they cashed it, no problem.. you guys are a joke. No wonder you're being sued you're crooks. I'll take my business elsewhere.

I transferred money from my savings account into my checking account to make a purchase on November the 9th 2016, because my checking account was at zero or at the very least was to low for my purchase. Monday I received a notice that I had an overdraft fee for insufficient funds, because the transfer was somehow still being processed. I called and explained to the customer reps that my account is negative because of the nsf charge and even so it is $14 less than the amount of the charge. I was told that the process must have taken place after the purchases even though I would not have had enough money to cover the charges that occurred after, and that there was nothing that they could do about it. The also told me not to use their app for accurate account balances.

Never in my life have I ever dealt with such an unprofessional customer service department or bank in general. I called with an issue regarding an issue with my bill pay (which was not my fault) and instead of correcting the problem they have allowed my account to go into the negative and are not willing to provide any assistance with getting rid of the returned check fees, overdraft fees or crediting my account the money that was sent out without being authorized. This bank is a joke and I wish that I would have never signed up with them. Do yourself a favor and go to a local bank where they actually care about their customers or a credit union where they're willing to help you out in any way that they can.

We've been customers with Wells Fargo since circa 1999. I used to love this bank, but it steadily declining. It would be so easy to change to another bank if it weren't for convenience. We use to have 2 home loans, 2 line of credits, and a credit card with WF. We're down to 2 lines of credits soon to be paid off.

You didn't mind taking our money for interest to the tune of almost $500 a month at one point, and you wouldn't reduce the rate on our credit card (that you doubled overnight) when we asked on numerous occasions. I was never so glad to pay off an account in all my life. I felt like I was being robbed. We've also paid off two home loans -- one a line of credit! In return, if we had $8,000 in the bank for the month, our interest was less than $1.

Last Saturday, we went to our bank located in the 300 blk of S. Hampton, Dallas in need of a notary. They don't have a notary, and won't have one for about another month we were told. We would have to go to another branch. It was 1:45pm, and we were told the location at Westmoreland and Illinois in Dallas had a notary until 2pm. We had about 10 min to get there and that would be cutting it close with the lights. We had to wait till another day.

I went there today and had my document notarized. I found out they have 8 notaries at this location, yet our location has none. Is this ineptness on the part of the manager at our location to not see that 2-3 employees are able to notarize a document? I was told today I was the second person from the S. Hampton location this week who has had to go to this bank in order to get business done. Supposedly, S. Hampton is a full service bank.

Can someone contact our branch manager on S. Hampton and make sure several employees become notaries so that if someone is on vacation, sick, or off that day, or out to lunch, someone is able to handle the job?

Worse customer service I have ever experienced. As a dedicated customer for a decade I would assume I'm a valued client. Unfortunately Erika Villegas (Simi Valley, CA) doesn't believe that after the uncalled for treatment I received Saturday. For a business that has been publicly shamed for their corruptions one would believe the your customer service should be extraordinary. However this is not the case. It was slow and Erika Villegas clearly didn't have alot in her plate yet she just couldn't take the time to listen to my issues that I have been having with my accounts for a month now.

As a result none of my concerns were even addressed, due to fact that your employee would rather give attitude than listen and help resolve any of the issues at hand. It is shame that this company would employ such a rude banker especially since she is the face to your company. I highly recommend to anyone in need of assistance to avoid Erika Villegas for you will not receive help but get disrespect instead. To save time and resolve any concerns wait for professional banking specialist, Ericka doesn't not meet any these qualifications

An overdraft credit card was opened by Wells Fargo Bank without my knowledge. In 2013, my husband and I opened two checking accounts and a retirement account, it was suggested by the banker that we fill out an application for a credit card for overdraft protection, which we did. We never received any correspondence from Wells Fargo about the credit card and assumed we did not get approved. Approximately eleven months later we wanted to refinance our rental property through Wells Fargo and discovered when my credit was run that I had a credit card which I never knew about or activated and now had my credit destroyed for not paying on it.

My husband and I had just paid over $1,000.00 to Lexington Law to get our credit scores raised so we would have better interest rates. I wrote to Wells Fargo both the local branch and corporate branch and got the run around. Apparently, The card was activated when Wells Fargo called my husband about our checking account even though the new credit card was not in his name, and it was never disclosed that we even had a credit card. Our first knowledge of this account was when we applied for the mortgage. We found out how the account was activated when we contacted the credit card branch of Wells Fargo but there was nothing they could do about it. We were charged fees and my credit was ruined because of this illegal card.

Today, October 4, 2016 at 11:55 AM teller Luis assisted me. I handed him my mortgage payment stub and check for October's payment, the check and the payment stub reflected 705.85. When Luis asked me to confirm my payment there was the payment of 705.85 and then right beneath that figure was a figure for 10 cents which made the total 705.95. I asked what the 10 cents was for and Luis said I wrote 705.95 on the payment coupon, which if I had it would not have matched my check.

I said are you sure I wrote 705.95 and then he looked at it again and said "Oh, I read it wrong". I asked him to cancel the payment and re-enter it, which he did, but I believe he should have confirmed the information while he was entering it the first time (payment coupon and check amounts are the same) and immediately said he would cancel the transaction and enter it correctly. He didn't apologize; actually was quite nonchalant about it and because of this I decided to file a complaint. I do not know what the outcome would have been if I had not asked him to cancel and redo the transaction. Concerned that I would be notified about an incorrect payment and end up with a late fee charge also came to mind.

I have banked with Wells Fargo for several years and have experienced numerous times when funds of $20 to $40 have been withdrawn from my checking accounts by some one other than me. When I called or visited the local office to inquire about these incidences I was always told I had probably made a mistake of some sort. Now I understand it is likely that an account(s) was open in my name by employees and funds transferred form my legitimate account into fraudulent ones. The amount of money involved is in the thousands. How do I get my money back?

I have been with Wells Fargo since the 90's. Over the last few years I have noticed something wasn't right and so did my daughter. Every month I get charged for insufficient funds fee that I could not understand how and why. I wake up one morning after morning with different balances and debits that have been paid then the next day they went back to pending. This happens all the time. I have multiple sclerosis and I have problems with just letting things go because I don't want to deal with the stress and also I did not want to think my bank would steal from me. I woke up this morning to find out my account was totally off, hundred of dollars off. I am on social security disability and I can barely live as it is much less have my money stolen.

Even though Wells Fargo is under review. They continue to scam money from customers. Today 9 -30 - 2016 I had a check come through this morning for 100.00 with a deficiency in my account of 15. Well Fargo has already charged me a $35.00 fee for a delinquent in my account. Even though today I will deposit money in my account to cover the check. The funds are in my account today to cover this check. But this "does not matter" to Wells Fargo bank. In Fact this has happened to me many times. And when I call Wells Fargo they have actually said to me too bad. We do are banking in the morning.

Now your probably thinking that this is my fault. But I am a victim of this economy. I have a small business and I live month to month. I work 80 hours a week and can barely pay my bills. Almost all the checks that I write are for shipments I must get out. Wells Fargo is a "Wolf" who knows that middle class (Which I am no longer) are suffering, and they "prey on us" Last year Well Fargo made over "3 Billion" dollars just scamming their customers with fees for insufficient funds in accounts. I am slowly pulling away from all banks because my trust with Banks Especially Wells Fargo and Wall Street is "0".

My complaint is that I have been with this bank since 1999. In the month of June fraudulent activity was done in the amount of over $4000.00. After numerous calls and visits to the bank and a devastating hold placed on my checking account funds, for over a month with numerous checks that was locked out for this. It caused insufficient funds to pay them due to the hold on my checking account. After that situation was resolved I was charged several finance charges on the fraudulent money ranging from $98 to 94 dollars in interest fees.

Tina the bank Supervisor was able to correct the problem. Great everything resolved, so I thought. This month October 22nd the loan balance that I owed personally to the bank showed on my statement that my loan balance was paid in full. the next day it was added back to the account but split up into (2) transactions not only did that happen but, I was charged a transfer fee and interest on both the transactions.

This was very, very upsetting to say the least. I called the 1-800 number and now they see the problem, admitted it was error on their part and that it would take 3-5 business days to resolve the problem. This is not going to happen as I have experienced this from the previous incident it is going to take me probably 3-4 trips to the bank 3-4 telephone calls to the 1-800 number before this is cleared up. Please bank customers of Wells Fargo be on the alert for any unusual activity.

Check your bank accounts, checking or savings and especially your loan account activity I discovered all the discrepancies on my own initiative. It is frustrating but please stay alert or you will be paying back money that you do not owe. The news alert has really kept my eyes opened. But as for as Wells Fargo as soon as I can refinance the loan I owe I will no longer need your service. So to all banking customers beware.

I open a Wells Fargo checking and savings account and was approved. The bank send me two debit card. I have money on my checking account. I tried to withdraw but Non of the card work. Two weeks later, I received a cashier check from Wells Fargo. No letter or what so ever. I called the bank and asked why. I was told they closed my account. I worried a bit because my paycheck was direct deposit. I was told not to worry, because they denied the direct deposit and that I have to talk to my employer. Wells Fargo employees cannot give me an answer why they closed my account and that all they know my account is closed.

I had a checking account with large deposits during a certain time of year, the first 6 months of the year and my balance was over 3,000 monthly. I used my account mostly to pay monthly bills and ATM cash withdrawals. In July 2016 my account was overdrawn an I knew it should not have been and upon further inspection of my account there were several unauthorized charges made but my account was still not what I knew my balance should have been. In August I received a notice from a company that I did business with advising that my account information attached to my debit card was compromised and it went back for over a year before the company realized that customer info was breached.

So I looked back further at previous transactions and found several more unauthorized charges and I disputed the charges and even provided the notice I received from the company about the data breach and length of breach. A Wells Fargo employee took it upon themselves to include a transaction I didn't dispute and that transaction was used as basis to deny my claim because the transaction was determined to have been done by me. When I advised claims department that I didn't include the transaction I was told oh well they would not review my claim anymore and the denial would stand. Then I spoke with a manager in the resolution department named Carlos who claimed he would have an agent look into the matter and call me in a few days but no one ever contacted me.

What do you do when an employee commits fraud against one of your customers?

Should be a negative star rating just for the CEO. I have been waiting for three months for a refi every one is on vacation all the time. Corporate head office spends too much passing the buck. They all say the same thing when asked about the delay.we work nights and weekends they say. I don't believe anyone has a clue what a hard day's work is at Wells Fargo they are too busy finding ways out of work and easier ways to scam the USA out of money.

I was one of the peasants that you people raped in the housing crash of 2008. Now you give one of your executives 124 million dollars because she did a good job perpetuating your fraud. You should be ashamed of yourselves. This whole culture is based on lies and deception now and you people are a huge part of it. I hope it comes down on your heads!

My Wells Fargo complaint is I open an account with a $50 deposit within 24 hours it was closed. I went to the bank to get my deposit back and was informed that I had a call 800 numbers after speaking to 6 different department each one blaming the other comes. Only to find out there was an account open project under my name in 2008. I thought I had fixed in 2010 now they're keeping my $50 and charging me 40 more for something that I had nothing to do need to know. Who can I talk to about my money and taking this damn project account out of my name?

Tried to schedule to have a safety deposit box drilled on saturday sept. 10th the day was confirmed but not the time, repeated calls to the branch have not been returned. I am traveling from Maryland to Arizona and stopping in westminster colorado to empty the box, a special stop for me. All I want is the time to be there. The wells fargo branch is on 7401 federal blvd in westerminster I am leaving Md. on Thursday morning sept 8th to be in westminster on the 10th.

I had a loan with Wells Fargo on a haul trailer and paid it off. After I paid it off they even sent me money back that I had overpaid. I did this just to make sure it was paid in full. Now I am getting billed for insurance on this bill and I have never had insurance with Wells Fargo. I had insurance with another company on the trailer I had financed with Wells Fargo. They will not listen on the phone and I even sent the papers proving I had insurance to no avail. Why do they keep billing me? I know if I do not pay it this will go against my credit. What a scam and extortion.

Wells Fargo adjusted my accounts back to my satisfaction. One day after I posted my complaint with Hissing Kitty.

I have visited different Wells banks four times, in an effort to update my mailing address for hard copy statements. I still do not receive statements, although very polite and enthusiastic employees find me on the computer, and assure me the needed data has been entered.In another vein, Wells has stopped including envelopes with their invoice for my monthly mortgage statement. No explanation, no marketing effort to demonstrate respect for the customer. No community building, by promising to donate the cost of their saved envelopes to local charities. No notice of any kind whatsoever. How disrespectful.

I go to Wells Fargo in Pendleton Oregon every day during the week for my work deposit and the manager (Judi Owens) at this location is horrible. She has a hard time understanding the simple job of a deposit most days. She also has some of the worst customer service skills ever! I had on a Star Wars t-shirt one day and she gave me a disgusted look on her face and said "really? Star Wars? You would really wear that in public?" I find this comment very unnecessary and rude.

I don't care who likes and doesn't like Star Wars but common sense says you keep your mouth shut either way. After talking with another Wells Fargo employee I found that she had told one of her employees that this employee is fat and that she should lose weight. I can't even begin to explain how dreadful that is! I am appalled that Wells Fargo would allow a person like this to move up to management level.

So, I checked online and found email address for Wells Fargo executives and emailed all of them. If you want to do the same, here they are: Howard.I.Atkins@wellsfargo.com, James.M.Strother@wellsfargo.com, Richard.D.Levy@wellsfargo.com, Mark.C.Oman@wellsfargo.com, and David.A.Hoyt@wellsfargo.com.

I have three checking accounts with Wells Fargo. One of them has a lot of automatic debits every month. It went into overdraft three times in a row so I put in extra deposits three times and wondered where my money was going.After checking with the local bank branch. I was told that over $5300. was deducted from my checking account for an automatic payment on my line of credit. This paid off the line of credit. It was supposed to only pay $40. minimum every month. They told me it was changed online probably by me.

I replied that I don't bank online, nor is it even set up. They figured they must have made the mistake. The first banker that I went to claimed to have it fixed. One month later it still wasn't. So I went to the branch that set up my line of credit. That manager got a hold of the line of credit person and when asked why the first banker did not get it fixed, she said, "well, that was only a request, not a demand." I was told it would take another month to fix. I still don't have the $5300. back and there was about half of it charged to my credit card. It is now over five weeks.

I went to Wells Fargo this morning and I wanted to do a cash advance and the guy told me he couldn't do it bc it was the exact amount and I have never have had any problems doing cash advance. He told me that I needed to go to another bank and I m a customer at wells Fargo for a long time. I m vey disappointed bc I am a loyal customer and I m not going to go to another bank to get money if I have an account with Wells Fargo.The bank I went to is the one in Mitchell Bridge Road. They supposed to help people and I try to call and the lady put me in hold.

1-800-869-3557 customer service for Wells Fargo is rude. They will ask you way too many questions not to be the claim department. Never get what you filed, funds never and up. And most importantly, why would you have to enter your pin for card to check your savings or checking with world wide customer service?

I had one of the worst customer service experiences today at a Wells Fargo location in Austin, TX. The address of this particular bank is 2028 E Ben White Blvd. I arrived at the bank around 11:05 or 11:10 (if memory serves me correctly). I added my name to the list of people requesting to see a personal banker before making a withdrawal up at the front with a teller. The teller was extremely helpful and efficient. When she asked if she could assist me with anything else, I told her I needed to speak with someone about my savings account. She asked if I had put my name on the list, to which I responded with a yes, and she told me someone would be with me shortly.

There were only 1 or 2 names before mine on the list. The lobby was under construction, so I milled about for a few minutes. Then, I waited in the doorway between the bank and the building's lobby for a few minutes as well. There were 2 parties waiting out in the chairs of the lobby of the building. When they were called back, I went and sat in the vacant chairs. I kept an eye on the 2 personal bankers at their desks to ensure I didn't miss my name being called. The lady who seemed to be the manager was greeting people as they walked in, about 3 feet away from where I was sitting. I made eye contact with her multiple times. Time passed. After about 20 minutes, I began to get impatient. I got up, went into the bank's lobby and made a point to check the list to see if my name had mistakenly been crossed off. The manager was right behind me as I did this.

There was a female personal banker who appeared to have no client in her office and was making small talk with the manager as I was sitting a few feet away, CLEARLY looking for someone to help me. More time passed. A man came in and the manager quickly went over and asked if all his needs had been met. And continued to ignore me. MORE time passed. Finally, the male banker had finished up with the couple he was working with, and I was sure he would go to the list, call my name, and it would finally be my turn. He got up, milled around the lobby, talked to the manager, and went back to his desk. The list was never looked at. I was never acknowledged or asked if I needed assistance. My name was never called.

A man entered the bank and wrote his name on the list. The male banker quickly jumped up, went over to him, and told him to come back to his desk so he could assist him. After I had been waiting for nearly FORTY minutes at this point, I was fed up and refused to wait any longer, be blatantly ignored by the manager, and come second to customers who had just arrived. I got up, scratched my name off the list (which apparently none of the bankers know how to use) and told the manager I could not wait ANY longer. She proceeded to tell me that she "didn't see me over there", which is hard to believe since we made eye contact many times, and she seemed to have no problem "seeing" customers leave and enter just a few feet from where I was sitting for almost an hour.

I've been with Wells Fargo for almost 7 years and I am normally very satisfied with their customer service. However, I felt incredibly disrespected by and irritated with my experience today. I highly doubt I will ever be returning to that branch again, as I can't afford to waste my time while management chooses to ignore waiting customers. I know there is nothing you can really do about an upset customer. However, as someone who used to work in customer service, I would NEVER want my customers to feel the way I do right now. I hope that branch and its manager learn how to treat all customers equally and ensure that no one has to wait for forty minutes without being helped (or at the least: acknowledged).

I read with great displeasure of Wells Fargo decision to support one political parties convention and not the other. While you may find a candidate holds views and beliefs contrary to your own, the convention is much more than a single candidate. If your decision to only support one party stands I will give serious consideration to pulling my business and investments now managed by Wells Fargo and find a more politically neutral bank.

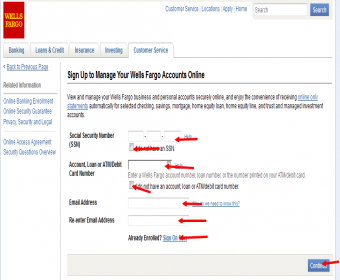

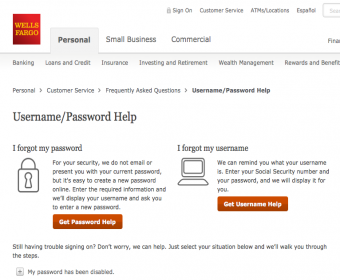

I’ve been in Wells Fargo in Miami, Florida on April, 8th 2016 and asked them how to open an account. I was very clear about not living in US and asked more than once if I would have any problem to use my account from abroad. The customer sales representative and the manager at the time told me that living outside US should not result in any problem. What happened is, when I was back home, I receive a message from Wells Fargo telling me that my credit card was sent more than 30 days so I should ask to cancel my card and request to send me a new one. For that, I should update my account address information and call customer service, so I start to do so.

And I’ve been calling since then, and they keep telling me that I CANNOT REQUEST A NEW CARD or even have online access to my account to request a new one without providing some information from my debit card – the same one, automatically cancelled and that they don’t have enough information about my profile to check my identity. I received the card 2 days after the first call, but the card was already cancelled. It was just a post service delivery delay. It has been a nightmare. All the money that I have transferred to Wells Fargo is blocked, I am not able to do anything with the money without a card. I will not keep transferring my money monthly until this problem is solved. I contacted the Service Representative by email and called many times ( 9 times so far) all the 800 phone numbers available and they’ve told me that I can only solve this problem if I go to US and go to a WF branch to personally identify myself.

It is important to say that when I opened the account I provided all the required documents and I have been told that there would not be any problem concerning identity and/or personal details in the future.

I am not planning to go to US. I live in the Middle East and I have a very tight work schedule and because of that, I am trying to get another solution other than take the first flight available to go to US (which would cost US 1,419.00 only for the ticket!)

I am one of your Wells Fargo customers, who have a report to make about one of your manager employees. Today, I came in to talk about my account to explain a few things. I asked her was there a way for me to stop someone from pulling out of my account so it wouldn't make my account negative, and she told me, "there was no way I could stop them." "If I owe them money, that they're going to get their money!" (Which was rude.) So then, I asked "IF I wanted to cancel my account, how would I go about with that?" She told me, what I had to do. So, I asked her another question, (about my account became in the negatives) and she wasn't quit being patient with me and was misunderstanding what I was asking her. So she rudely told me to "bring in my 109 and cancel my account!"

Which wasn't right of her to raise her voice and tell me to cancel my account. Then, I asked was there a manager or someone else I could talk to and she said " I AM THE MANAGER!" There's no one else I could talk too. So I brought it to you guys, because canceling my account isn't what I wanted to do. I just wanted to fix a few problems and she gave me a really bad customer service experience. Her name is, Senitres Boyd, store manager

This is not a complaint about customer service it is about community responsibility. I live in Canon City, Colorado and have been a customer of Wells Fargo since 1974 and was an employee in Denver for 24 years. The main branch of Wells Fargo on Main Street in Canon City has a small plaza next to it that is part of the bank property. It has two small fish ponds, a statue, and several planted areas. To be frank, it is disgusting! The ponds are filthy, there is trash all over, and there is even a manhole that is broken that could easily severely injure someone. These small communities are trying to revitalize and improve economically and this eyesore on Main street is not helping. Quite frankly, it would not take much money to clean up this area and maintain it for the enjoyment of the tourists and community. Please address this with the local management in Canon City. It would go a long way in improving the image of the branch here.

I called the credit card department about fraud on my account. I was confused to why the amount of the fraud was on my credit card with no hold on it. The way this male representative talked to me referring to me as not remembering things was very rude. I had done everything I was told except I misunderstood about the procedures this fraud was attempted and my checking account not being cancelled. I thought Wells Fargo was canceling it out for me, but he told me I have to close it at Wells Fargo Bank. At the time of the fraud I was under a lot of stress dealing with the death of my daughter in-law and I find his remarks very insulting. I have been a customer of Wells Fargo for numerous years without any complaints until now. I did and I am doing everything explained to me at the time of the fraud.

Dear Mr. Stumpf, I am very upset with the wrong information I received from one of your Personal Bankers. The gentleman's name is Corey Hudson, who works at your Willingboro NJ Branch, I am a retiree from Wachovia Bank for 22 years of service and in my years there we ALWAYS treated our clients with the correct information and ALWAYS returned hone calls to our clients. I visited the bank because our Kennedy Branch was closed and I wanted

my sons names put on my safe deposit box in the event they could go and get necessary papers for me. At the Kennedy branch they had access but there signature cards were not forwarded to the Willingboro branch. I was informed by Mr. Hudson that all my sons needed to do was go to a branch in Delaware and Pittsburgh to sign a new card with their ID.

My son in Delaware went to a branch in Middletown, DE and was told I had to bring my son here to New Jersey to fill out a new application and a also my son in Pittsburgh. I am a widow and I need my sons names on my box.

Your manager in Delaware was very nice and said I received the wrong information in your Willingboro. I call the branch today 5/7/16 and spoke with Mr. Hudson and ask him to give a message to his manager to please return my call before end of business today, Raman Kaur, manager and she did not call me. When I worked for the bank our manager always said to return phone calls to our clients. I would truly like to get this resolved for my state of mind. I am quite sure if you were a widow and your children were not close by you would want for them to be able to take care of their parents business in the event of death. I would appreciate your help this this matter and I thank you for your time.

Your employees at the Willingboro Branch need more training in professionalism and good customer service. I thank you again.

So I received a debit card for my checking account. However the card was broken in two during mailing. So I tossed the card into the bottom of a drawer and ordered a replacement. Several months pass. I find that I am getting charges to my account from India. I start checking and I find that the card being used is the one which is broken, never activated nor used in the bottom of the drawer where I put it.

I go to the WF bank and they blame me for not being careful about using my card. After I show the card to the teller his mouth fell open. As I told him about the card being broken on shipment to me, never used, never activated. Several employees are looking at the card, still with the call this number sticker to activate. I am chastised for not being careful about charges. Its all my fault that someone in the WF bank activated and used or sold the card information. I caught them. WF Bank employees are activating and using the cards or selling card information. They dropped the charges from the card. I closed my account and have gone to a much better credit union.

This is the third time in only a few years that my cards were compromised and I never could find out how or where. Now I know and Wells Fargo bank is not the place to put your money. I try to let everyone know that I can. Check out the complaints about any given bank or credit union before trusting them with your information. Above all, run don't walk away form WF Bank.

My Wells Fargo Credit Card was stolen recently and was used twice without my approval. I called Wells Fargo to report the illegal use of my card. My problem was that I had to give the same identification information 4 times to 4 different people before anything was resolved. That took approximately 30 minutes to accomplish a task that should have been resolved within minutes. Why should I have to repeat myself with the exact same information 4 times? Surely, the computer system that Wells Fargo uses is sophisticated enough to transfer information to the proper office without having to repeat myself 4 times as I was transferred from office to office.

Lastly, the last person I talked to wanted to know if someone else was in the room. There was, but your employee then rudely began some tirade concerning privacy. I had given permission for my friend to overhear the conversation. My friend then took the telephone and explained to the 4th person that a simple task of reporting the fraudulent use of my card had become a "comedy of errors." Finally, the problem was resolved, I hope. II would hope that a better system could be established to make for easier business undertakings.

I would like to report the impolite attitude and terrible customer from the operation Supervisor and the Teller and that I have received at 9550 Bolsa Ave Well Fargo Bank branch in Westminster on 3/18/2016 at 5:30PM when I tried to make a deposit into my checking with $1,000 in half dollar coins that have been wrapped nicely in the coin wrap (the coins came from my piggy bank). I stopped by this branch since I am on the way to Bolsa. First, the male teller asking me to wait for the approval from his supervisor to see if he can accept the coins, then later one of the teller associate came with him to the window and told me that their supervisor can only allowed for one time favor to accept deposit of $200 as max for coin, unless I do have business account with the bank.

The teller clarified with me that this is the bank policy, there is nothing she can do. I asked her if there is any restriction in deposit with paper money, she respond "NO". I also have explained to them that this is only one time deposit, and I do not routinely deposit coins, so I need their help to make an exception but they continue to refuse to take coins in. I was frustrated and disappointed, so I took the coins back home. To validate the Bolsa teller response in regard of Wells Fargo bank deposit policy, I called another branch in Murrieta nearby my home, asking them if they can accept the $1000 coins deposit, and they said there is no problem as long as they are in coin wrapping paper.

I would like to address my concerns with Wells Fargo bank for coin deposit policies and the misleading statement from Bolsa branch. As a PMA and value customer with Wells Fargo for quite some time, I felt that I was not treating fairly and misleading by the operational supervisor and the tellers at Bolsa branch when I got different answer of coin deposit from another Wells Fargo branch.

I like to be advised the followings from Wells Fargo Bank. Why did Wells Fargo bank discriminate of receiving coin for deposit? Aren’t coins also money? If Wells Fargo exchange coins for customer, why does bank not get the coins back? The bank is the largest institution to circulate money in society, by discriminating in accepting coin the bank has limited the customer deposits and make it difficult for customers to dispose their coins. Overall, coins came from bank when customer do exchange. I am not sure if this has violating federal regulations? Why were there discrepancies in policy of coin deposit between branches? How does Bolsa branch can come up with different policy than other Wells Fargo branch? Or is this one of many discourteous, ruthless customer services that Bolsa branch has been treating customers?

Wells Fargo refused to expedite a new debit card for me. I have no access to funds for use to purchase gas, groceries, cash through the ATM machine etc. I cannot visit a local branch as my work hours do not accommodate those hours. I offered to pay an expedite fee and they still refuse saying I should take off of work to get a card. I will be pulling all 5 of my accounts and my 20 year relationship with Wells Fargo as they are nothing but money hungry hogs. They want new business, new accounts, new loans every time I walk in the door but can't perform a single customer service request to accommodate me?

On March 5th 2016 I called well Fargo phone line assistance to have one of my debit card reissue. Well Fargo for some unknown reason had cancelled one of my debit card so I called in order to have the card reissued but after hold on for more the 15' my call was passed to a customer service named Claudia she was very rude. After asking several ridiculous questions then she ask whether I remember the date of my last transaction - how a person can remember when the card was rarely used, she can see that too - and she then hang up on me when I said how can I remember.

So I call back after giving an active debit card even giving the pin number and I reached a customer service name Maria she asked my first and last name I did give my name the same as the first time but this time Maria said I did not give her the information same as her information so she had refused to help me. Is this conspiracy between those to customer services to give me hard time ? Or they forgot their job is giving the customer their best effort to help a customer? We are Well Fargo customer sine 1983 and I was treated badly. one should wonder how Well Fargo customer service would treat it's other customers when they are in need of help like me. I can't recall any other banks have this awful customer service.

I had a question about being charged an excessive activity fee in my saving account while having over $500 in there and also being denied to make the actual transaction to my checking account. I spoke to "Abby" who was unhelpful and later transferred to supervisor "Mark", and then he chuckled, said hello, and then hung up. After calling again I spoke to "Gale" for 3 seconds before she complained of not hearing me rushed her ending speech and then hung up. Im an not racist in any way as I also ethnic, but the fact is this is a complaint and the truth demeanor of everybody I was connected to was young, hispanic females with an attitude, except for "Mark" who was a young hispanic guy doesn't take things serious.

Been a customer when they purchased my previous bank. Always wells Fargo seemed okay, few dealings were taken care. But God forbid you run into hard times, the friendly neighborhood bank turns into your worst nightmare. Nobody loves having difficult times, our life took a hard turn and we were struggling to stay afloat. This lead us to file bankruptcy, very low point but we needed and had to go this direction. Had my first disrespectful phone call but was able to work it out, 3 months later struggling to pay mortgage and utilities. Wells Fargo decides to yank out the only 500 dollars I had in account. Never telling me in anyway just took it leaving me with one dollar to pay weekly bills.

Never in my life would I think a bank can not only do that but treat you with the rudest people ever. Hardship is not enjoyable in any means, we are stressed and disappointed but getting by. The only thing that makes it bearable is people that understand and have compassion. Wells Fargo has none, we are leaving and finding a bank that cares. We are not fortunate like the executives at your bank but we are people. We work our whole life to get everything pulled out. We will overcome this and will be happy using a new bank. Why must your bank think being a bully and kicking someone who stayed true with wells Fargo. I may be small and not worth your time but I believed in your bank.

Today afternoon I went to this bank and want to put my money order in the card. I asked one staff where the ATM is. She told me do this in the desk. Ok I was waiting. Then it is my turn and the operator who let me sign. Because the owner is my wife,so I don't signature. But I asked where is the ATM and I want to use that. Because I do the same thing last time on the machine.

I came out and let my wife sign on it. Then waiting for the machine.In the end I found the ATM don't provide the service. Now the bank is closed. I am very angry and asked the women. She told me that she don't know whether the ATM has the service and her attitude was bad impatient. I wasted lots of time and got more angry. Maybe I had the Asian face and maybe I should leave the freedom state.

On 02/11/2016 I cashed a check for $3179 and requested cash back of $1079 and the cash back amount is short by $300. I had this money to pay my bills that is due on the 22nd of February and to celebrate my birthday which is the 20th of February so the money was not counted until the 20th of February when I notice the cash back amount was short $300.The cash missing from the cash back amount is 2 - $100 bills and 5 - $20 bills. I called the local bank here and spoke with Trinity. The tone of her voice was not reassuring. She checked the teller transactions for that day and stated she was not over or short for that day. I've been with Wells Fargo for a few years and never got a cash back receipt with the breakdown of the cash given back to me.

That was a red light for me when I started counting the cash. I would like someone outside of the branch to investigate this transaction because it takes to people to count and verify the cash drawers for the tellers. I hold on to all my receipts for this type of reason and mistakes. There was time from Feb 11th to Feb 20th to contact me of the mistake that was made on the teller behalf and this didn't happen. From now on I will check my cash before leaving the bank whether inside or through a drive thru window. I'm waiting to hear back Monday from Wells Fargo Branch #0006727 9 and if I'm not refunded back by $300 I will be moving on to another bank.

A check was written to Wells Fargo for $8,067.67 (which looks like a forged signature) on 10/6/2015 AND a cashier's check for $21,378.84 on 10/7/15. I need to know why this money was withdrawn from the account. I have power of attorney for my mother's account. I'm writing this complaint on her behalf. She deposited a cashier's check for $10,000 on 10/2/15 and the above checks were written 4 & 5 days later. Please help me open an investigation and find out the whereabouts of almost $29,000 of my mother's money. Customer service has been a joke!

My 92 year old mother has repeatably been denied access to her security box she has been told many times to wait a few minutes and those wait have been over an hour. No progress has been made she leaves in frustration please remedy this A.S.A.P. It's hard for her to drive down there and she pays rent on the box.

On December 5, I called your overseas collect call number (925-825-7600) from my temporary home in Thailand. My WF Visa credit card has an expiration date of 2016-01-31 and I wanted you to send the new one to my Thailand address, not my California address. The person I spoke with got my address here and said it would be taken care of. A couple of days later I received an email from you stating the card had been mailed out. Since I hadn't received the card by January 13, 2016 I called again and was told that a computer malfunction kept the new card from going out. That was an unlikely explanation but whatever. I gave my Thai address, again, and was assured the new card would be Fed-Ex'd out by the next day.